The major systems upgrade it undertook in early April and the disruption in services that ensued earned the Bank of the Philippine Islands (BPI) the ire of its customers. But for the country’s oldest bank, it was a bitter pill to swallow to propel the 168-year-old company to the digital age.

BPI chair Jaime Agusto Zobel de Ayala and BPI president Cezar Consing offered an apology during the bank’s recent annual stockholders’ meeting but made it clear that the company’s future growth will be built around digital technology.

This is because the bank has seen firsthand the transformative power of technology as it was the first to introduce the ATM (automated teller machine) and online banking in the country.

In fact, BPI has spent P11.6 billion in technology in the last three years with over a third of the amount devoted to building capacity and capability in new cutting-edge ways.

At the stockholders’ meeting, Consing said the main part of the bank’s digitalization journey is already done with the upgrade of its deposits systems.

“The system is core to almost everything we do, and must be state-of-the-art if our digitalization initiative, which has tripled the number of online transactions in barely five years, is to continue its momentum,” Consing said.

He noted the legacy system was already about four decades old and was no longer compatible with new system versions that would allow for increased capacity.

“Unfortunately, a process that in a test environment took less than a day to complete, and had been scheduled over a full weekend, spilled over to the following week, inconveniencing many of our clients,” Consing shared.

“The undertaking was enormous. We made changes to 21,000 programs, 15,000 lines of codes, and 5,100 copy books — over 41,000 changes in all. Clearly, this was a challenging exercise, and we regret the inconvenience that this caused,” he added.

Despite the massive interruption to its banking services, Consing said the migration was needed. “Digitalization is the future and we will stay the course. Our clients deserve the best of what the future has to offer,” he remarked.

The executive revealed that the first phase of the bank’s digitalization journey took almost three years to complete. It involved building the foundational digital infrastructure, which also meant “de-layering” its technology architecture.

“We built a state-of-the-art cybersecurity operations center, commenced with the upgrade of our core systems and adopted Agile [software development] to create capacity, improve turnaround time, and enhance customer experience. This phase supported a 13.8% average annual increase in transaction volumes over the same period,” Consing emphasized.

For the second phase of its digitalization efforts, Consing said the focus will be on these nine areas:

- The orchestration of a digital ecosystem;

- Becoming the partner of choice for digital platforms and ecosystem owners;

- Reshaping payments in the country;

- Pushing for financial inclusion;

- Digital lending and cash management for SMEs;

- Digitalizing E2E processes;

- Adopting a mobile first distribution strategy;

- Adopting the latest digital marketing methodologies to accelerate customer acquisition; and

- Leveraging big data and advanced analytics

The official said a successful execution of the second phase of its digitalization journey could contribute an additional 20% revenue uplift by 2023.

Digitalization, according to Consing, would also allow BPI to become more financially inclusive by significantly increasing its engagement with segments of the market where the banking system is woefully underrepresented.

This early, he said digitalization has enabled BPI micro-finance subsidiary BanKo to become the first tech-driven bank in the country to focus on financial inclusion.

BanKo makes loans to self-employed micro-entrepreneurs such as a stall operator in a public market, a beauty salon operator, or a neighborhood bakery. In just three years, it has made over P4 billion in loans to almost 60,000 entrepreneurs.

“It will have a robust, secure, and scalable cloud-enabled system that supports basic loans, deposits and mobile wallets as well as provides access to digital channels and payments,” Consing said.

Consing said Open Banking is another example of how digitalization is allowing BPI for much greater engagement with other players in the financial sector. Open Banking refers to making services available as APIs (application programming interfaces) to fintech and e-commerce companies like GCash and Lazada.

“We are happy to see this initiative gaining traction with our 40 APIs and 10x more partners for a variety of platforms that facilitate online shopping, travel, payment of utilities, and the transfer of funds to e-wallets,” he said.

For consumer banking, the executive proudly stated that the BPI Mobile App is now the most downloaded local finance app in both the Apple App store and Google Play. Active users of BPI Online and BPI Mobile grew by 16% in 2018, he added.

He also underlined the fact that the BPI Mobile App now allows funds to be transferred via the use of QR code, features the use of one-time PINs for security, and allow clients to set account control features.

“We believe that today, we are the Philippine bank with the highest digital adoption rate in terms of number of users,” Consing said.

Ultimately, he said digitalization will make the experience of its clients seamless as they move from physical channels like branches to digital channels like BPI Online and BPI Mobile.

“Our digitalization will allow for an omni-channel experience, with clients being able to start a transaction in one channel and complete it in another,” Consing said.

The official said BPI is also building a digital culture within its own organization as this is crucial in creating the appropriate mindset among its employees.

“We are now focused on building a digital culture with the same focus that we apply when growing our loan book, expanding our branch network, or improving our financial and operating metrics,” he said.

With a vision and strategy in place, BPI has tapped two veteran executives to lay groundwork and lead the charge in the bank’s massive digitalization efforts.

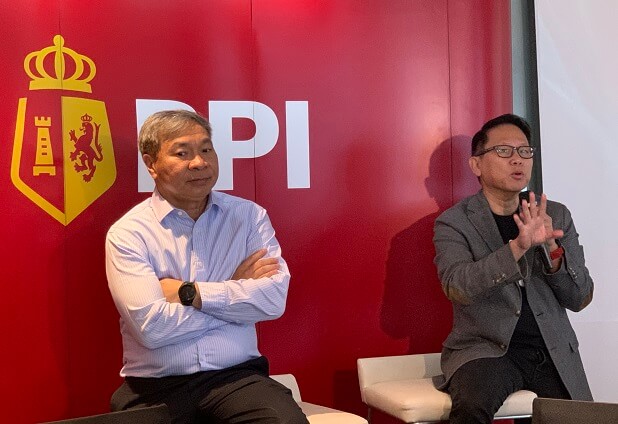

The main man on the ground is Ramon Jocson, a former country manager of tech titan IBM Philippines, who is now the bank’s executive vice president and chief operating officer. He basically oversees the company’s overall tech initiatives.

With him is Noel Santiago, an old-hand in the banking industry now serving as BPI’s chief digital officer. Prior to going back to the Philippines, Santiago worked as head of the technology division of a major Singaporean bank.

In a recent roundtable discussion, Santiago retraced the numerous technological developments in the banking industry over the years – from the mainframe systems that revolutionized computing to the mobile apps that clients now use pervasively.

“But it was the ATM which actually transformed the financial industry because it took away the need to go to a teller in a branch. This ushered in the self-service era and changed the traditional way of banking dramatically,” Santiago said.

And while the industry has grown with the advent of the Internet, it did not experience the same profound change which the ATM brought some 25 years ago. “It was not really transformational because it only performed the same thing in a different platform,” he noted.

With the coming of the mobile era, however, the game is changing radically yet again. “With mobile devices, it is not just automating or making it convenient. It is about how you’re interacting with the clients, so we’re calling it experiential,” he said.

Despite the technological upheaval in the local banking industry, Santiago said the sector is still at least a decade behind when it comes to global digital banking standards.

“We’re catching up. But it’s not the fault of the banks or the consumers. The infrastructure in the country did not allow us to introduce 3G or 4G-based digital banking services,” he said.

The entry of two foreign-owned banks with an all-digital model is also not bothering Jocson, who said that banks need an “ecosystem” around them to fully function as a digital bank because 90 percent of financial transactions are still done in cash.

Unlike in other countries, Jocson said the Philippines does not have yet an active national ID system — although a law was passed last year — which pure digital banks can use as a credential to onboard clients. Thus, it could take up to seven working days to sign up a single client – an awfully long time for a digital bank.

Another problem for all-digital banks is the clearing of digital checks, according to Jocson. “The PCHC or the Philippine Clearing House Corporations does not have the technology to process watermarked checks,” he said.

But things are happening quickly, especially with 5G technology just around the corner, Jocson said. “We have the entire ecosystem with the right digital strategy to lead on all fronts,” he said.