The Bank of the Philippine Islands (BPI) said it has partnered with digital payment firm Beep to allow BPI Mobile app users to purchase Beep QR tickets for rides aboard the BGC Bus service and Topline Marina in Cebu.

BPI chief digital officer Noel Santiago said contactless payments have become more popular among consumers who keep a safe distance from having to touch bills and coins that may have gone through countless hands amid a viral pandemic.

“We’re still in the pilot phase of this new function, so for now it is only available for Metro Manila clients who have the BPI Mobile app and take the BGC Bus, and for Cebu-based clients on select routes aboard Topline Marina,” said Santiago. “We hope to expand the service to more routes and transportation hubs, as Beep expands the availability of more onboard QR scanners.”

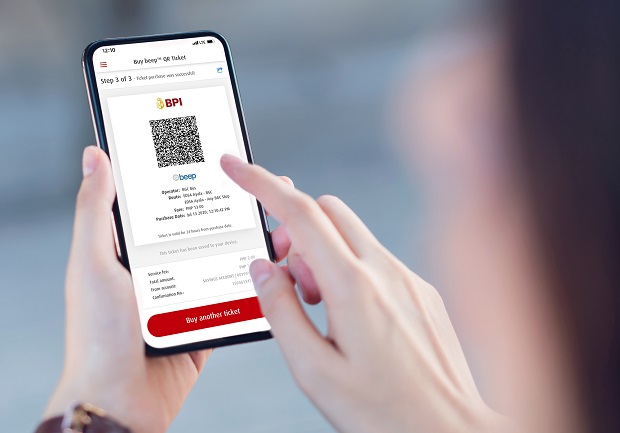

To make it easier for commuters on the go, Beep QR tickets can be bought directly from the login screen of the BPI Mobile app, where clients can select their route and pay securely. The QR ticket is automatically saved on the device and ready for scanning upon boarding the bus. Each QR ticket is valid for 24 hours after purchase.

“The Beep QR ticket function is just one of the many new features that we’ve developed for our digital platforms to help our customers deal with the Covid-19 situation,” said Santiago. “We are constantly enhancing our BPI Online and mobile app features, and we are accelerating the availability of the most relevant functions to our clients at this time.”

One of the latest features allows clients to customize their account dashboards through accessing BPI Online on the Web browser. The changes are reflected in the mobile app for a consistent cross-platform experience.

Users can manage their accounts and transactions by toggling based on priority and preference. Preferred clients will also have a differentiated look and feel for their access to BPI’s digital channels.

“We encourage our clients to make the digital shift.” Santiago says, “We have designed these features to make our clients’ everyday banking needs easier, more secure, and accessible.”