According to the recently published VMware Digital Frontiers 3.0 Study conducted by software firm VMware, the Philippine financial sector is ripe for growth through digital transformation.

In a press briefing to release the study’s findings held on Thursday, July 22, top VMware regional executive Sanjay Deshmukh pointed out that Southeast Asian consumers are more prepared to consume digital services then consumers in other nations.

The Philippines was no exception. With 73 percent of Filipinos shown to be open to the idea of contactless payment and 55 percent preferring to engage with banks via apps rather than visiting in person, the research revealed that Filipino consumers are unmistakably ready for the shift to digital services.

Covid-19 played no small part in this readiness. The pandemic upped Filipinos’ willingness to trust advanced technologies like artificial intelligence and facial recognition.

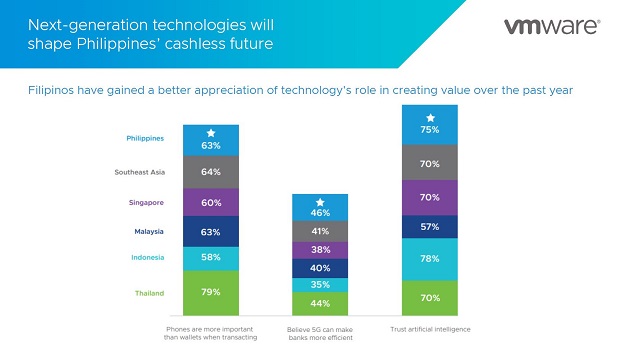

In particular, out of all other Southeast Asian consumers, Filipino respondents are the most trusting of 5G with 85 percent believing in this innovation. Forty six percent of those surveyed additionally think that 5G can make banks more efficient by processing applications and credit checks faster.

“Digital-first financial services firms have a huge opportunity in the Philippines as the pandemic last year has significantly changed the way Filipinos engage with brands digitally,” said VMware Philippines country manager Walter So.

“Beyond accelerating innovations and driving competitive advantages for digital banks, harnessing frontier technologies such as cloud, facial recognition, and 5G can also help reduce barriers that hinder financial access and close the financial inclusion gap in the Philippines.”

The increasing trust in technology is also accompanied by new standards for digital experiences. The research indicated that a make-or-break features that Filipinos watch out for in digital banking are security and privacy.

Eighty three percent of the Filipino participants considered security as the top priority when choosing a financial services provider. Furthermore, 56 percent of these respondents felt paranoid that organizations were tracking and recording what they are doing on their devices.

User experience was another major consideration for Filipinos. Sixty four percent of the study’s Filipino respondents made it clear that they would switch brands if digital experiences did not live up to expectations.

The report suggested that Philippine financial services organizations should not only take full advantage of the technology available to them, but their foremost aim should always be to provide an experience that guarantees security, privacy, and ease of use for their consumers.

Embarking on the digital shift, however, is easier said than done. Financial institutions face challenges specific to their industry when attempting a digital transformation, the study said.

One of the largest barriers is their legacy IT and apps, which refers to the technology infrastructure and processes banks have been using for decades that have become outdated.

Other difficulties include ensuring compliance with their security processes and the slow time to market for new services. To take advantage of the Philippines potential for growth, VMware recommended that the country’s banks focus on prioritizing a multi-cloud, app-led ecosystem that focuses on the consumer, drive connectivity, and innovation in a distributed work environment accessible by employees through any device, and to ensure intrinsic security across their platforms.

“The most important thing… is to ensure that this is all delivered safely and securely. Intrinsic security is embedded into all these solutions rather than considered as an afterthought,” said VMware APJ chief technology officer Guru Venkatachalam.

“They cannot follow the old ways of doing things where there are long, drawn-out planning processes. They need to be more agile and there is an urgent need to produce this digital and customer first kind of experience for their customers. Our goal at VMware is to enable that for our customers,” Deshmukh emphasized.

VMware Digital Frontiers 3.0 Study is a global study conducted from November to December 2020. The sample was composed of 1,000 consumers per market from the Philippines, Malaysia, Indonesia, Thailand, the United States, the United Kingdom, Germany and France.