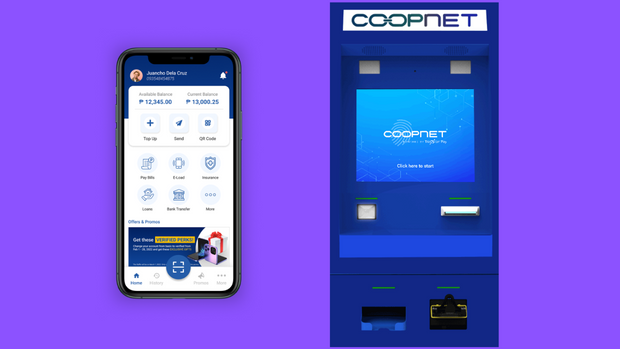

Financial technology startup Traxion Tech has succesfully developed a cardless teller machine for its network solutions arm CoopNET which can be accessed completely using a smartphone and system-generated QR codes to provide more options to underserved cooperatives and financial institutions in far-flung areas in the Philippines.

The CoopNET Teller Machines (CTMs) are designed to provide a facility for payment collection and disbursement to customers via integrations with banking institutions, the interbank network of BancNet, e-wallets, and remittance centers.

“The use of QR codes is being done right now especially by other mobile applications. The main objective of the QR code technology is for financial inclusion, so that more financial institutions will be able to provide the same service as the other bigger banks,” said Ann Cuisia, CEO of Traxion Tech in an exclusive interview with Newsbytes.PH.

Cusia also reassured customers of the security layers and authentication methods in place for the CTMs, virtually ensuring protection from cyberthreats and social engineering. Since the CTMs have less contact points, keypad skimming or card stealing is no longer a viable avenue of attack for criminals.

Multiple factor authentication delivers a secondary layer of protection, while the QR codes encrypted with a time-based generator removes the instance of third-party exposure. The physical CTMs are also equipped with hidden cameras for dispute reporting, while the backend applies authentication protocols required by each partner bank network.

“Since it’s app based, the concern that your money will be stolen from you when the phone gets stolen, just like with other popular e wallets, the bad actor won’t be able to access that without knowing your phone pin and your app’s code or password. We expect a few hundreds of Coopnet Teller Machines rolled out by the end of 2023,” she explained.

In rural areas, CoopNET fills the gap caused by financial institutions who are unable to rollout BancNet ATMs due to cost, compliance, and generally limited capacity that comes with smaller banks. Cuisia hopes to build an tech-enabled inclusive system that boasts interoperable payment solutions.

“The innovation aims to strengthen the relationships between the Filipinos and other financial institutions that huge commercial banks do not cater to. We are serving not only cooperatives but also thrift banks, rural banks, micro-finance and lending institutions,” she added.

Before using the CTMs, customers will first have to download the CoopNET Mobile APP through the CoopNET website, the Google Play Store for Android, the Apple App Store for iOS, and the AppGallery for Huawei smartphones.

The current features of the CTMs include cash in, cash out, pay bills, e-load, and fund transfer. CoopNET plans to take a by region approach when rolling out its machines until it achieves nationwide presence.