The Securities and Exchange Commission (SEC) has brought Suncash Lending Investors Corp., UCash Lending Investors Corp., Suncredit.ph Finance Corp., and ECredit Finance Inc. before the Department of Justice (DOJ) for criminal prosecution for operating unregistered online lending platforms (OLPs).

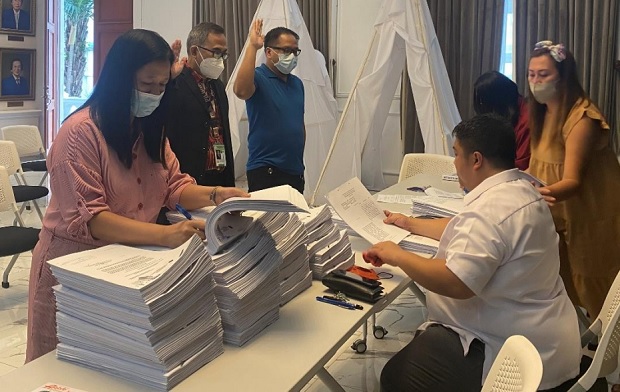

Photo from SEC

The SEC Enforcement and Investor Protection Department (EIPD) filed on December 20 a criminal complaint against Suncash, UCash, Suncredit and Ecredit for failing to disclose its online lending applications (OLA), in violation of Republic Act No. 9474, or the Lending Company Regulation Act (LCRA) and Republic Act No. 8556, or the Financing Company Act (FCA).

The agency implicated Qi Lu, president of Ecredit, Suncash, and Suncredit, who was also found to be the beneficial owner of Suncash alongside Zhu Junfeng, who is also a director of the three other companies.

Also implicated in the complaint were other incorporators, directors and officials of the companies, including Chang Yuting, Joyclyn V. Pelayo, Chang Tao, Bryan Dordas Pelayo, Jasmin Tabjan Vianzon, Jayson Lee, Meng Jie, Xiaofang Song, Danilo Felicilda, Roger Publico, Yaping Liu, Xianming Tian, Shiling Xu, Xiaobo Pan, Sheila Pagkalinawan, and Xiaojing Luo.

The EIPD, together with the Philippine National Police Anti-Cybercrime Group (PNPACG), Eastern District Anti-Cybercrime Team, Manila Police District, and the Special Weapons and Tactics Philippines (SWAT), previously implemented a warrant to search, seize, and examine computer against Suncash, as part of the SECs crackdown against unregistered lenders.

The Makati Regional Trial Court Branch 147 issued the search warrant against Suncash upon several complaints received by the PNP-ACG and the SEC against the company.

During the implementation of the search warrant, it was discovered that other lending companies, including Ucash, Suncredit, and Ecredit, had been operating alongside Suncash in its headquarters in Sampaloc, Manila.

The joint operation resulted in the arrest of 83 individuals, identified as operators, managers, employees, and agents of Suncash.

Records show that Suncash had been operating three unregistered OLPs, namely Suncash, Flashloan, and Peso Pautang, contrary to what is stated in its affidavit of compliance that it operated no other OLP than Suncash.

The EIPD also said that Suncash operated the unregistered OLPs to circumvent and defy the moratorium imposed on the registration of new OLPs effective November 5, 2021. Meanwhile, Ucash filed an affidavit for the operation of its OLP on December 7, 2022, when the moratorium on new OLPs was still in effect.

Further, the EIPD charged Suncredit and Ecredit which were found to be the operators of Peso Pautang and Flashloan, respectively.

The commission also noted that all the companies engaged in abusive, unethical, and unfair debt collection practices.