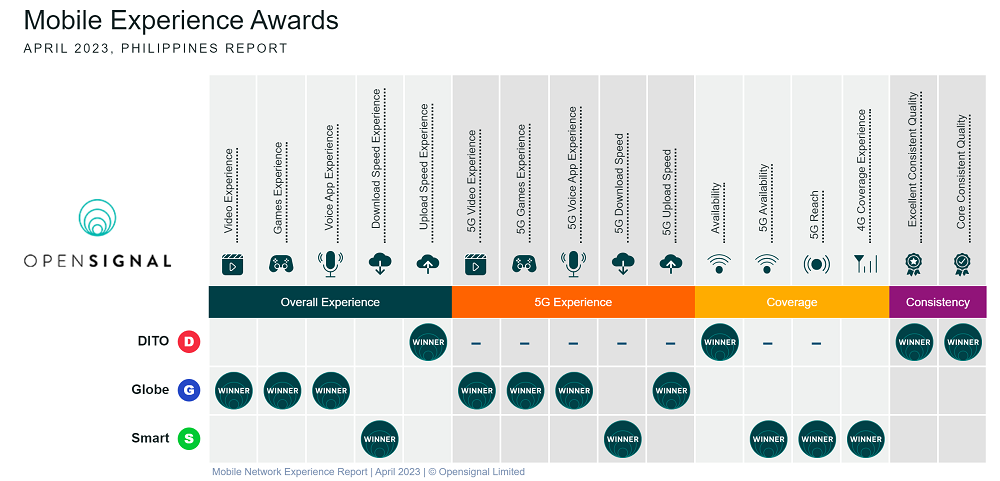

Although Smart Communications has dominated Opensignal’s mobile network experience reports on the Philippines for a long while, increased spending by Globe in 2022, the introduction of a third national operator (DITO Telecommunity) and the launch of 5G has shaken things up.

Mobile metrics analyst OpenSignal in its new analysis further cited Globe’s record-high of P101.4-billion investment on its mobile and fixed networks last year which means the company continues to focus on improving infrastructure.

The operator beat its own rollout targets for 2022 — with 2,267 new 5G sites built, and more than 13,600 mobile sites upgraded to 4G, OpenSignal said.

Opensignal further said network investment has had a big impact on the mobile experience, as Globe users spend more time with an active connection and have a better video experience than Smart and DITO users.

Looking at time spent connected to 4G/5G, time with no signal and the proportion of time spent with poor 4G Reference Signal Received Power (RSRP) — a measure of signal strength — Globe is top for all three, OpenSignal said.

OpenSignal said that would be wise for Globe not to get complacent though, as both Globe and Smart saw a large rise in mobile traffic in 2022 — with year-on-year growth at 25% for Globe and a whopping 30% for Smart.

With greater network usage, operators need to invest more to avoid increased congestion. If they don’t, then users’ network experience will suffer, and they will risk increased churn, OpenSignal said.

Globe has the highest percentage of users with a “Very Good” video experience, and the lowest percentage of users with a “Poor” experience.

Users on Globe’s network consistently spend the most time with a mobile connection, compared to DITO and Smart. Splitting the metric into segments, Globe has the highest percentage of users that spend less than 1% of their time with no signal.

DITO and Smart have a lot of catching up to do for 4G signal strength. The pair have a much higher proportion of users with Poor (less than -115dBm) 4G Referenced Signal Received Power.

In the Philippines, two of the most important metrics are Video Experience and time with no signal.

OpenSignal said it has segmented users’ experience rather than showing the average scores, which can obscure the proportion of users struggling with a suboptimal mobile experience.

Globe has the highest percentage of users (88.3%) that spend less than 1% of their time with no signal. This is 1.7 percentage points better than Smart, and Globe outperforms DITO by 3.5 percentage points.

At the other extreme, looking at the percentage of users that spend over 5% of time with no signal, Globe once again does best. The operator has just 4.3% of users spending 5% or more of their time without a signal, with Smart again playing second fiddle with 5.2% of users — while DITO has some catching up to do with 5.9% of users.

There is a slight break in the pattern for Video Experience with Smart leading in the proportion of users with an Excellent Video Experience; DITO and Globe are just behind, both with the same percentage of users — 6%.

This changes when looking at the other categories — compared to DITO and Smart, Globe does far better. Globe has a much higher percentage of users in the Very Good category and a far lower percentage of users that have a Poor Video Experience, the report said.

This distribution indicates users on Globe will likely enjoy a more consistent video experience than users on Smart’s or DITO’s networks, OpenSignal further stated.