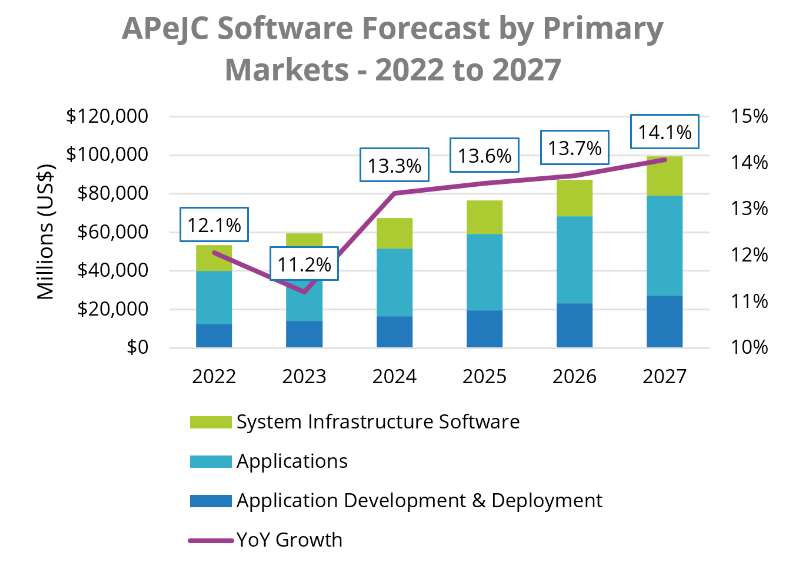

The software market in Asia-Pacific excluding Japan and China (APeJC) region recorded a 12.1% year-over-year (YoY) growth to reach $53.5 billion in 2022, according to analyst firm IDC.

Some softening can be expected in 2023 as the region grapples with global economic uncertainties, inflationary pressures, and supply chain disruptions, before it stabilizes towards the later part of the year.

The size of the software market is expected to hit $99.3 billion by 2027, representing a 13.3% compound annual growth rate (CAGR) over the 2022-2027 period.

“The region remains highly resilient – fueled by economic recovery in China and the normalization of digital initiatives in a post-pandemic era,” said Chris Zhang, senior research manager for software, data, and analytics at IDC Asia Pacific.

“The software industry has also become less susceptible to economic downturns as technology forms an integral part of an organization’s digital strategy, and the shift to public cloud services has also provided some revenue stability for the industry.”

Customer and employee experience, data-driven decision making, and automation were mega themes that drove software investments in 2022.

Artificial intelligence platforms, collaborative applications, and integration and orchestration middleware were the top three fastest growing secondary markets with a YoY growth of 35.8%, 28.3% and 21.4% respectively in 2022.

The Application Development and Deployment (AD&D) market posted the strongest YoY growth of 12.7% in 2022 with the highest five-year CAGR at 17.1% through 2027.

Customer experience has mandated organizations to place data at the core, leveraging on various technologies (AI/ML, cloud, data lakes and warehouses, integration/orchestration, etc.) to eliminate data and system silos and support real-time decision making.

The adoption of modern development tools and practices such as microservices, APIs and DevOps also plays a pivotal role in agility and time to market for digital products and services.

While Generative AI (GenAI) has taken the industry by storm, CXOs and business leaders are more interested in practical applications, governance and implications/risks around ethics, security, and IP, etc.

As the largest software segment, the applications market grew 12.4% YoY in 2022 with a projected 13.3% CAGR by 2027.

AI-infused/AI-centric applications are quickly becoming the next generation of applications, with emphasis on interconnectedness and automation to unlock employees’ productivity, enhance operational efficiency, and transform experiences. This has directly boosted the demand for software development and modernization tools in the AD&D market.

Lastly, collaborative applications can be expected to be one of the least susceptible to budget reductions as hybrid work becomes a mainstay.

Intelligent automation is alleviating the issue of talent scarcity in the system infrastructure software (SIS) market, which grew 10.8% YoY in 2022 (projected to grow at 8.7% CAGR from 2022-2027).

Interests around “AIOps” or “NoOps” to “do more with less” and navigate complexities in hybrid cloud environments have risen over the last 24 months, while early mainstream adoption of containers and Kubernates was observed amongst enterprise organizations.

Security budgets to remain resilient as securing corporate resources in a hybrid working model remains a key focus, according to IDC.