New data from analyst firm IDC showed that the wearable devices market declined 0.9% year over year in the fourth quarter of 2023 (4Q23).

Despite improved economic conditions, mature markets such as United States, Western Europe, and Japan recorded declines in 4Q23 due to muted demand, tough comparisons against last year, and inventory hangover from prior quarters.

However, shipments grew 1.7% in Asia-Pacific and in China largely due to strong interest in emerging markets.

“The high-water mark for wearables came in 2020 and 2021 with volumes reaching record levels. The next two years saw the aftermath of that success as demand began to wane and shipments steadily declined,” said Ramon T. Llamas, research director with IDC’s Wearables team.

“2024 will be the start of the rebound as users will look for replacements and new models from key vendors launch during the second half of this year. This will carry into 2025 and beyond.”

While the market declined slightly in 4Q23, global shipments of wearable devices managed to grow 1.7% for the full year 2023.

Among the various device types, hearables declined 0.8% year over year for the full year while capturing 61.3% of the overall wearables market.

The slow pace of innovation and fast pace of adoption has quickly led to the category relying more on replacements rather than new buyers.

Meanwhile, smartwatches continued their growth trajectory as shipments increased 8.7% during the year as India and China led the market both in terms of vendors and consumption.

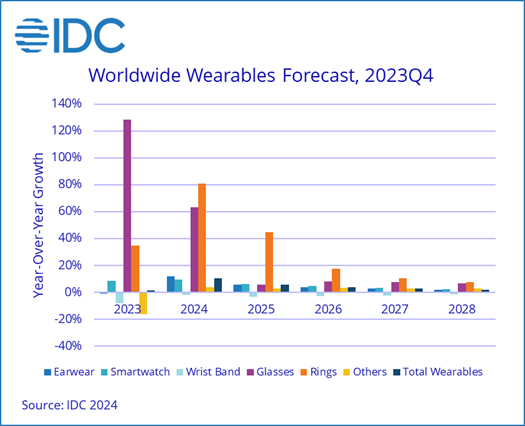

Rings, such as those from Oura and Ultrahuman, showed promise with the category growing 34.9% during the year while glasses without a display grew 128.2% due to the launch of new products from Amazon and Meta.

“Rings have caught the attention of consumers as new brands begin to gear up their launch plans,” said Jitesh Ubrani, research manager at IDC.

“By providing a discreet form factor and multi-day battery life, rings avoid some of the key shortcomings of smartwatches and hence appeal to a broader audience. However, the form factor has long relied on a subscription-based business model, which is expected to subside in the short term as competition heats up.”

With the global economy on a path to recovery, wearables are poised for additional growth in 2024 as device shipments are forecast reach 559.7 million units, up 10.5% over 2023.

From there, IDC expects the market will grow to 645.7 million units by the end of 2028 with a compound annual growth rate (CAGR) of 3.6%.