Gokongwei-led JG Summit Holdings Inc. (JGS) has secured a stake in Tyme, a fast-growing digital bank based in South Africa which is seeking to explore emerging markets in developing economies particularly in Asean.

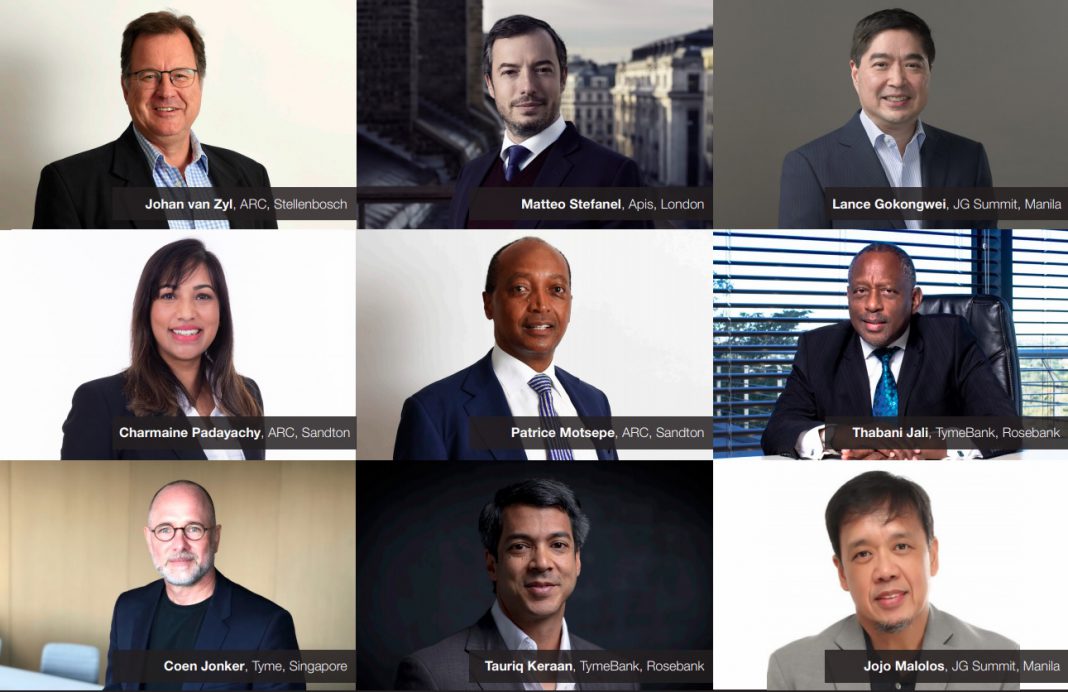

JGS has taken part in an estimated P5.3-billion total investment in Tyme, along with Apis Growth Fund II, a private equity fund managed by Apis Partners LLP, and South African investment holdings company African Rainbow Capital (ARC).

Tyme, whose international management arm TymeGlobal is headquartered in Singapore, is considered as one of the world’s leading digital banking network for emerging markets, and is majority owned by ARC.

The capital raise will be primarily deployed to grow TymeBank in South Africa, which has attracted 2.8 million customers to its digital banking platform since its launch in February 2019. It is reportedly one of the largest foreign investments any fintech company has secured in South Africa, affirming the dynamic growth of the local banking sector.

With the move, JGS, through its corporate venture capital vehicle JG Digital Equity Ventures (JGDEV), is boosting its foray into the fintech industry as part of its goal of becoming one of the biggest digital conglomerates in the country and in Asean.

With Tyme in its portfolio of investments, JGDEV brings to the JGS ecosystem a deeper understanding of the success of digital banking in developing economies such as South Africa with the aim of replicating it in a similar setting such as the Philippines.

JGS Summit is looking to bring Tyme’s digital experience and innovation to the Philippines to support the initiatives of the Bangko Sentral ng Pilipinas (BSP) in bringing inclusive financial services further into its population.

“We see digital banking as the next growth area globally and increasingly in Asean and so we are excited to partner with global investment giants Apis and ARC in taking part in this global play by building further success for South Africa’s leading digital bank TymeBank,” stated JGS president and chief executive officer Lance Y. Gokongwei.

“The investment not only propels the Gokongwei Group to accelerate its foray into disruptive digital plays, it also allows us to learn more about TymeBank’s experiences that provide a good impetus for us in considering to apply their technology and success in the Philippines,” he added.

JGDEV president and CEO Jojo Malolos said JGDEV will use Tyme’s experience and success to create significant value to the core businesses of the Gokongwei Group while leveraging on the its ecosystem to further drive digital transformation for the conglomerate.

“Covid-19 has accelerated adoption of digital technologies in the country and for us, this investment reinforces our capability to bring financial services deeper into the group’s ecosystem and the underserved segments of the Philippine population. Tyme’s disruptive innovation will help us to better adopt an agile and innovative mindset to provide better choices to customers,” Malolos said.

Established in 2019 as the corporate venture capital investment arm of JG Summit to focus on next-generation digital businesses, JGDEV’s current portfolio includes:

- iPrice, Southeast Asia’s leading shopping companion that offers consumers a catalog of 5 billion products;

- digital procurement tool Growsari targeted toward digitalizing local neighborhood retail or sari-sari stores;

- all-in-on hotel operating system Zuzu;

- virtual logistics platform Zyllem; and

- consumer data analytics tool Snapcart.

As one of the most diversified Filipino conglomerates, JG Summit has commercial bank Robinsons Bank in its portfolio, along with business interests in aviation (Cebu Pacific), real estate (Robinsons Land), food manufacturing (Universal Robina Corporation) and petrochemicals (JG Summit Petrochemical Corporation) among many others.