The Bangko Sentral ng Pilipinas (BSP) said on Wednesday, April 27, that it has decided to pursue the pilot project of a central bank digital currency (CBDC) to promote the stability of the country’s payment system, particularly digital payment.

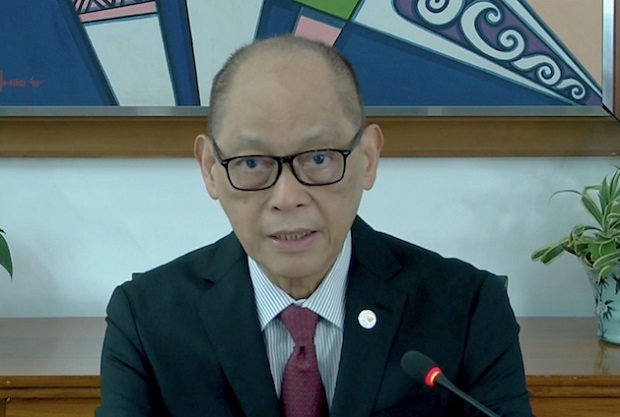

Photo from BSP

Dubbed Project CBDCPh, the pilot will test the use of CBDCs for large-value financial transactions on a 24/7 basis across a limited number of financial institutions.

According to financial website Investopedia, CBDCs are digital tokens, similar to cryptocurrency, issued by a central bank. They are pegged to the value of that country’s official currency.

During a recent roundtable discussion at the IMF-World Bank Spring Meetings, BSP governor Benjamin E. Diokno said “Project CBDCPH” marks a major step not only for the Philippine central bank but also for the entire finance industry to better understand the opportunities and risks of wholesale CBDCs.

“Learnings from the pilot will be critical in constructing the BSP’s medium- to long-term roadmap for more advanced wholesale CBDC projects that shall further strengthen the Philippine payment system,” Diokno explained.

Project CBDCPH will be led by an intersectoral project management team to ensure coverage of critical operational areas. These include policy and regulatory considerations, technological infrastructure, governance and organizational requirements, legal matters, payment and settlement models, reconciliation procedures, and risk management.

In contrast to general purpose or retail CBDC intended for use of the general public, a wholesale CBDC is restricted mainly to banks and other financial institutions.

Diokno said that a wholesale CBDC may contribute to addressing frictions on large cross-border foreign currency transfers, settlement risk exposure from using commercial bank money in equities, and operating an intraday liquidity facility.

The BSP said is exploring the potential use of wholesale CBDCs in areas where these can yield the greatest value-adding benefits to the payment system.