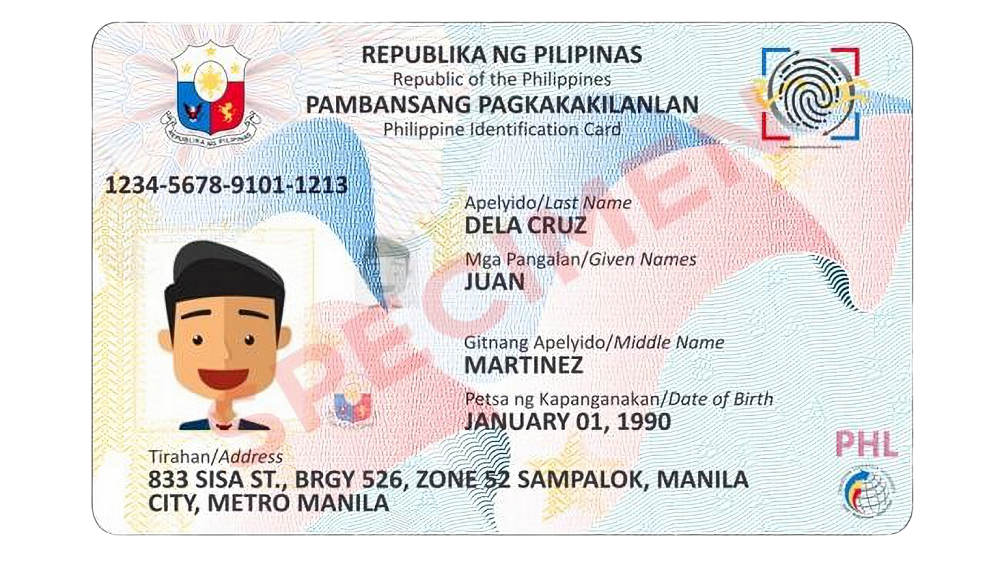

The Bangko Sentral ng Pilipinas (BSP) has directed banks and other BSP-supervised financial institutions (BSFIs) to place the Philippine identification card (PhilID) at the top of the list of acceptable valid IDs, being the official government-issued ID.

The central bank issued the memorandum apparently due to continuing complaints that some banks refuse to recognize the national ID as proof of identity because the card itself does not display the person’s signature.

The BSP said all banks must adopt enhanced measures to ensure the broad acceptance of the PhilID, whether the physical card or the ePhilID, as a valid and sufficient proof of identity and age in all financial transactions, subject to authentication.

The BSP said banks may use the PhilSys Check identity authentication tool to verify if the data stored in the QR code match the information printed on the face of the ID.

The BSP, through Memorandum No. 2024-006, requires banks to display the list of acceptable valid IDs in conspicuous places within their premises — on counters and the public entrance of their establishments — as well as on their official websites, social media pages, and other consumer information channels and promotional materials.

Further, banks are instructed to extensively disseminate the said memorandum to all personnel and branches concerned.

The BSP’s memorandum is part of the ongoing program to ensure the effective implementation of the Philippine Identification System (PhilSys).

Republic Act No. 11055 or the PhilSys Act and its Revised Implementing Rules and Regulations provide that an individual’s record in the PhilSys shall be considered as an official and sufficient proof of identity.

The PhilID serves as the official government-issued identification document for transactions with all national government agencies, local government units, government-owned or -controlled corporations, government financial institutions, state universities and colleges, and private sector entities.

The BSP has identified the national ID as a driver of financial inclusion in the country by serving as proof of identity for opening formal transaction accounts.