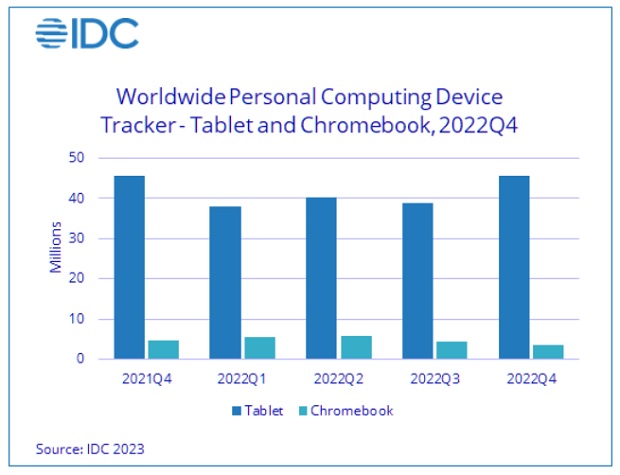

Worldwide tablet shipments posted flat growth of 0.3% year over year in the fourth quarter of 2022 (4Q22), totaling 45.7 million units, according to research firm IDC.

For the full year 2022, the tablet market saw a decline of 3.3% year over year, ending two years of solid growth although shipments remain well above pre-pandemic levels.

Meanwhile, Chromebook shipments continued to contract in 4Q22 with shipments totaling 3.6 million units for a year-over-year decline of 24.3%. Shipments for the full year were down 48% in 2022 after an astounding 180.5% growth in 2021.

Apple and Samsung continued to be the main drivers for the tablet market.

Apple remains the indisputable leader in this space and gained ten percentage points in market share compared to 4Q21. The vendor launched several new products in the quarter – the 11″ and 12.9″ iPad Pros and a 10.9″ iPad – which were well received.

The delayed launch of these products and the low base for comparison due to constraints in their supply chain drove the gains for Apple in 4Q22.

Samsung benefitted from continued efforts in effective resource management, especially to fulfill several projects in Asia-Pacific (excluding Japan and China) and Western Europe. The vendor has also been focusing on its premium tablet lineup to help build shipment volume.

For Amazon, even though the fourth quarter is generally its best shipment quarter, two Prime Day sales in the year and the overall softness in the demand led to reduced shipments in the quarter.

Lenovo and Huawei finished the quarter in a statistical tie for the fourth position. Lenovo’s shipments have been in decline due to several commercial projects coming to an end.

Huawei’s increased focus on marketing large screen tablets in their main geographic market, China, is paying off and they’ve managed to remain in the top 5 despite many hurdles.

Tablets, which were once used mainly for entertainment, have gained momentum in a range commercial applications. Faced with a looming economic downturn and market saturation, vendors will need to focus on the commercial segment to drive sales in the coming years.

“We are currently amidst changing market dynamics. While affordability and simplicity of use will continue to be some of the key drivers for the market to sustain, consumers have also begun to evaluate the importance of higher-spec devices when making purchase decisions,” said Anuroopa Nataraj, senior research analyst with IDC’s Mobility and Consumer Device Trackers

“As a result, vendors will need to focus on evolving their tablet portfolio. In addition, 2022 saw some new players like Xiaomi and OPPO enter the market offering consumers a complete solution that is connected across devices, enriching the user experience.”

“In this changing environment, it will be necessary for vendors to rethink their product portfolios to cater to consumers, education, and corporate in an effort to drive demand.”

“While Chromebooks have faced a tough few quarters, the excess channel inventory that had built up is starting to subside and could potentially lead to more normalized growth in the coming quarters as back-to-school season returns,” said Jitesh Ubrani, research manager with IDC’s Mobility and Consumer Device Trackers.

“However, any traction that Chromebooks made outside the education sector will continue to suffer as the economy stalls and as tablets and PCs supplant Chrome-based devices.”