Mocasa, a fintech company specializing in credit payment services, announced that it has become an Accessing Entity (AE) of the Credit Information Corporation (CIC) and is now authorized to access the CIC credit database.

The company said through this milestone, Mocasa aims to revolutionize the financial services industry by leveraging advanced technology and data analytics to offer enhanced credit and payment solutions to consumers.

This collaboration, it said, brings the expertise of a financial technology firm together with the wealth of credit information in the sole public credit registry.

CIC, a government-owned corporation, maintains a credit database covering 41.8 million individuals, or almost half of the Philippine adult population, from across 829 financial institutions of various industries.

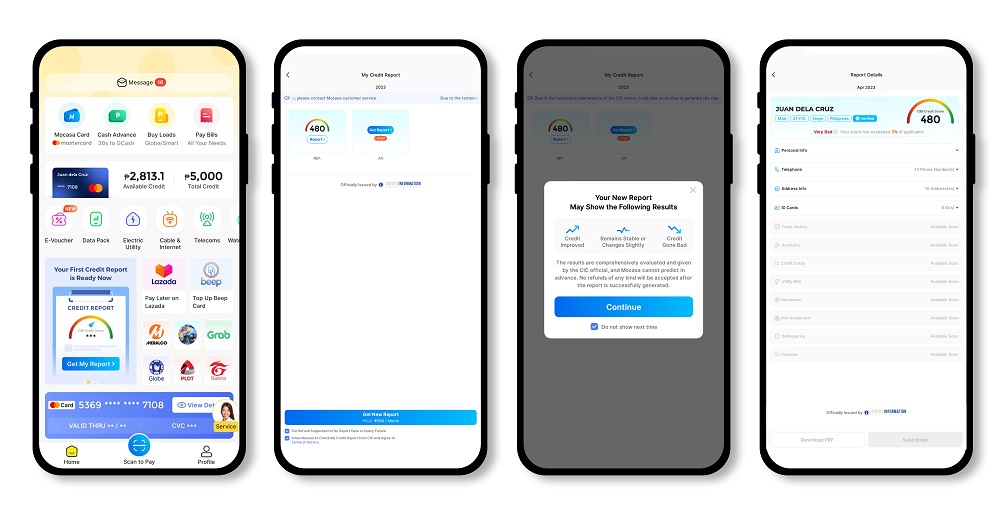

By being an AE of the CIC, Mocasa users will soon gain access to a wide range of financial services, including personalized credit reports, credit scores, and credit monitoring.

The accessibility of borrowers’ credit data from the CIC within the Mocasa app will enable users to make informed financial decisions and manage their creditworthiness more effectively.

Additionally, Mocasa will leverage CIC’s strong data capabilities to develop advanced risk assessment models, resulting in enhanced fraud detection and prevention measures.

“We are excited with this development as we would be able to harness the power of cutting-edge technology and comprehensive credit data,” Robin Wong, CEO of Mocasa, said.

“This effort actually represents a great step towards our vision of empowering Filipinos with better financial solutions. By enabling our users to conveniently access their credit data from the CIC within our app, we aim to provide our users with actionable insights to help them better manage their credit responsibly and unlock new opportunities for financial growth.”

Valdimir Hubert H. dela Cruz, CIC senior vice president, also expressed CIC’s support to Mocasa: “By being an Accessing Entity of the CIC, Mocasa extends the reach of credit information services to consumers and fosters responsible borrowing. Furthermore, they can now use CIC data to formulate data-driven credit-decisioning, calibrate better risk management, improve their credit portfolio, and increase access to credit for Filipino borrowers.”