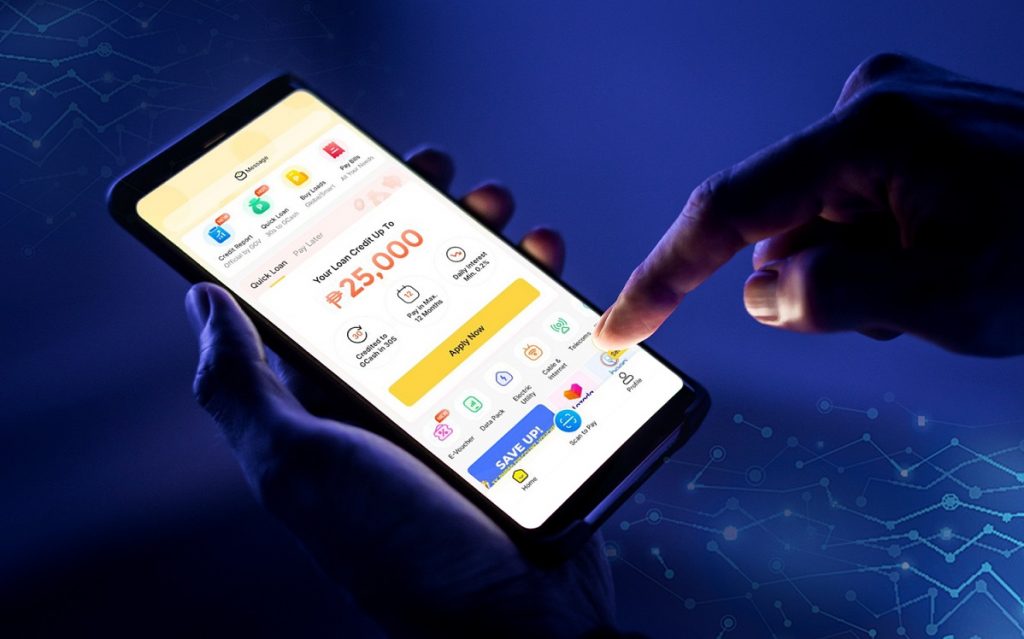

As we look ahead to 2024, the financial services industry, particularly in the field of digital lending, continues its transformative journey in the midst of the digital age’s rapid expansion.

According to projections, the digital lending business in the Philippines will be worth $350 billion by the end of 2023. This substantial gain can be linked to ongoing advances in financial technology, a significant increase in online transactions, and the growing importance of small and medium enterprises (SMEs) in the country.

This rise, however, is not an isolated occurrence; it is part of a larger regional trend, with Southeast Asian smart cities expected to reach a daunting $236.7 billion by 2030.

While the Philippines’ digital lending sector is on an upward trend, it is important to realize the untapped potential for future expansion and improvement. Both financial institutions and government agencies have played critical roles in the sector’s advancement, but there is still a pressing need for coordinated measures to fully realize the potential of the Philippine fintech and digital lending landscape.

The joint search of innovative approaches and the incorporation of emerging technology will be critical to realizing the next phase of growth and maintaining the long-term viability of this thriving sector.

Role of financial institutions and regulators

Financial institutions and government regulators have both played critical roles in shaping and stabilizing the digital lending environment. Collaborative efforts in developing legislation and implementing industry standards have created an atmosphere suitable to growth.

However, as the digital lending market evolves, these stakeholders must stay adaptable and aggressive in responding to new trends and issues.

Mocasa, the pioneering virtual credit wallet in the Philippines, together with online lending industry leaders recently met with Securities and Exchange Commission (SEC) commissioner Kelvin Lester K. Lee. The purpose of the meeting was to collaboratively devise strategies to combat illicit online lending activities and establish professional practices in debt collections.

While the precise details of the discussions cannot be disclosed at present, the evident collaboration between online lending entities and government regulatory authorities signifies a promising avenue for future developments.

The vital role of SMEs

Small and medium-sized businesses (SMEs) are the backbone of the Philippine economy, contributing significantly to job creation and innovation. Their continued performance is critical to the nation’s overall economic prosperity. Recognizing the critical role of technology in SME success, the creation of innovative tools becomes critical.

Innovative technologies, such as data-driven credit scoring systems and customer data platforms, help SMEs negotiate the difficulties of today’s business market. Not only can these technologies improve access to financial resources, but they also create confidence between businesses and financial institutions.

Intelligent automation streamlines operations even further, allowing SMEs to concentrate on strategic decision-making and value-added activities. Embracing these innovations is more than just a business plan; it is a road for SMEs to thrive and adapt in an ever-changing economic environment, assuring their long-term growth and success.

Embracing technological advancements

The incorporation of technology into the digital lending sector is not only a trend, but also a requirement for long-term success. Looking ahead, we must invest in and implement cutting-edge technology that not only speed lending processes but also improve risk management and customer experience.

Intelligent automation, machine learning, and blockchain are poised to transform the sector by laying the groundwork for secure, efficient, and transparent financial transactions.

Addressing cybersecurity challenges

The expanding digital ecosystem not only provides new opportunities, but it also increases the potential surface area for cybersecurity risks. This increased susceptibility is especially obvious given that the Southeast Asian smart city industry is expected to reach $236.7 billion by 2030.

In this scenario, protecting important industries critical to online lending, such as energy, insurance, health, and logistics, becomes more than a priority; it becomes a fundamental requirement.

Because of the dynamic nature of online transactions, as well as the growing reliance on digital platforms for loan services, a coordinated effort is required to protect the digital infrastructure against potential cyber threats.

Collaboration among financial institutions, regulators, and cybersecurity professionals is critical to strengthening the digital resilience of the online lending ecosystem.

This collaborative strategy should include the ongoing improvement of encryption techniques, strong authentication processes, and proactive monitoring systems to detect and mitigate any cyber threats as quickly as possible.

As the digital lending market evolves, a united front against cyber vulnerabilities will be critical in the next years to ensure the confidence and security of online financial transactions.

Conclusion

The Philippines’ digital lending market is full of promise and possibility. Despite substantial progress, the road ahead requires sustained collaboration, innovation, and adaptability.

To move the digital lending sector into a new era of growth and prosperity, financial institutions, regulators, and SMEs must all embrace technology advancements, strengthen cybersecurity safeguards, and address difficulties head on. By doing so, the Philippines may establish itself as a global fintech trendsetter, setting new norms for financial innovation and inclusivity.

The author is the chief executive officer of Mocasa