The Bank of the Philippine Islands (BPI) has joined hands with Digital Pilipinas to spearhead the TrustTech movement to promote confidence among individuals and businesses in the local digital landscape.

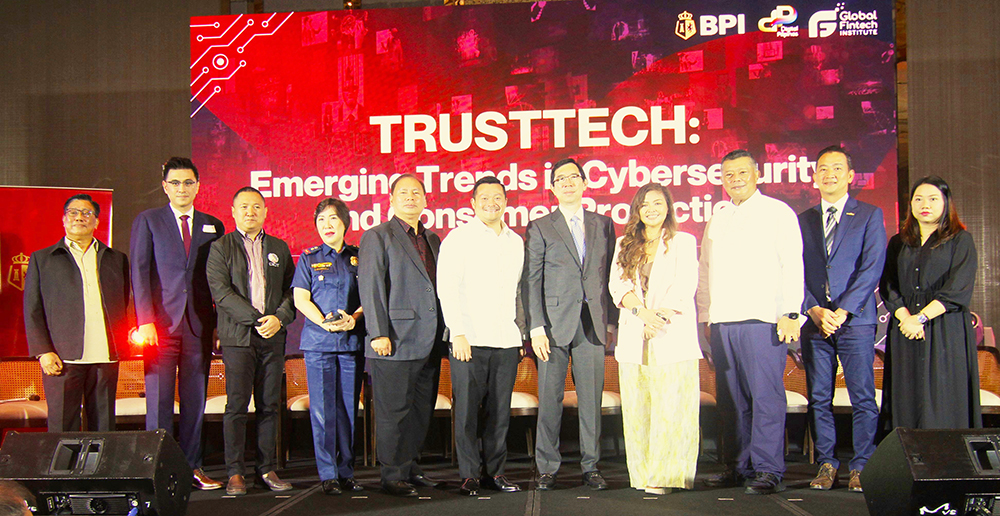

The initiative was launched during a conference held at the Shangri-La The Fort in Taguig City last July 28.

Speakers from the Global Fintech Institute (GFI) provided insights, while panel discussions included participation from the government, foreign representatives, and the private sector.

During the conference, BPI president and CEO TG Limcaoco emphasized the importance of building trust and fostering reliable relationships within the digital realm.

He emphasized the need for advanced technologies, robust security measures, and consumer protection prioritization to create a digital ecosystem that instills trust, encourages innovation, and sustains growth.

BPI has taken on the role of TrustTech convenor of Digital Pilipinas, marking a significant step in their collaborative efforts.

The TrustTech movement advocates for a whole-of-nation approach to tackle cyber scams, with a focus on educating the public about cyber threats and implementing policies to safeguard both businesses and consumers.

Given that digital payments accounted for 42% of total retail payments in 2022, as reported by the BSP, the conference provided a platform to share best practices and policies to deter cybercriminals.

“Our goal is to make the financial systems inclusive and efficient, especially since more and more Filipinos are adopting the convenience of digital financial transactions,” Limcaoco said.

“However, we are aware of the growing threats brought about by financial cyber scams. Threat actors have been taking advantage of new financial technologies to prey on our banking customers,” he said.

“Thus, we are adopting our efforts and raising awareness about cybersecurity and the different ways that the general public can and should protect themselves from these threats,” Limcaoco said.

The Ayala-owned bank said it remains committed to investing in technology, refining processes, and providing employee training to prioritize privacy and cybersecurity.

Additionally, BPI engages in information campaigns with governmental, media, and industry organizations to educate clients about the latest schemes.