According to analyst firm IDC, the hard copy peripherals (HCP) market in Asia-Pacific registered 7.2 million units shipped in the second quarter of 2023, declining by 10.2% Year-on-Year (YoY).

The year-on-year decline in inkjet and laser products can be ascribed to reduced demand from Asia-Pacific customer groups in all segments except small offices and very large businesses.

The highest YoY drop occurred in the consumer segment, followed by the government segment, and SMEs.

The APeJ region’s overall inkjet market dropped 13.5% YoY. The drop in ink cartridge model purchases can be attributed to the significant YoY decline in China’s ink cartridge market. In China, the drop in consumer income has had an impact on printers’ purchases.

The reversal of pent-up demand for inkjet printers is linked to a YoY decline in the inkjet market in other Asia-Pacific countries such as Australia, Korea, and Malaysia.

These countries’ households’ printer purchasing needs have been met throughout the pandemic. Indonesia, India, and Thailand all saw an annual growth in the inkjet market.

The rising demand for color 1 to 20 ppm ink tank models among students, households, and micro-businesses aided the YoY market in these countries.

The APeJ laser market fell 6.5% year on year. The decline can be attributed to lower demand for laser printers and copiers from government, enterprises, and SMEs in countries such as China, Korea, and Vietnam. Thailand, Taiwan, India, Australia, and Malaysia all had annual growth in the laser printer market.

The YoY growth in these countries, particularly in the laser A4 printers’ market, was fueled by the work-from-office trend, as well as demand from the enterprise, government, education, and SME sectors.

“We expect India to be one of the fastest-growing HCP markets this year. It will be driven by demand from the BFSI, SMB, enterprises, micro-businesses, and education sectors,” said Apoorv Kandharkar, market analyst at IDC Asia Pacific.

“In the short term, the demand from non-metro regions and rising print volumes would help propel the Indian market. Demand from government entities is predicted to scale further in the second half of the calendar year, as several government programs are expected to reach their peak soon.”

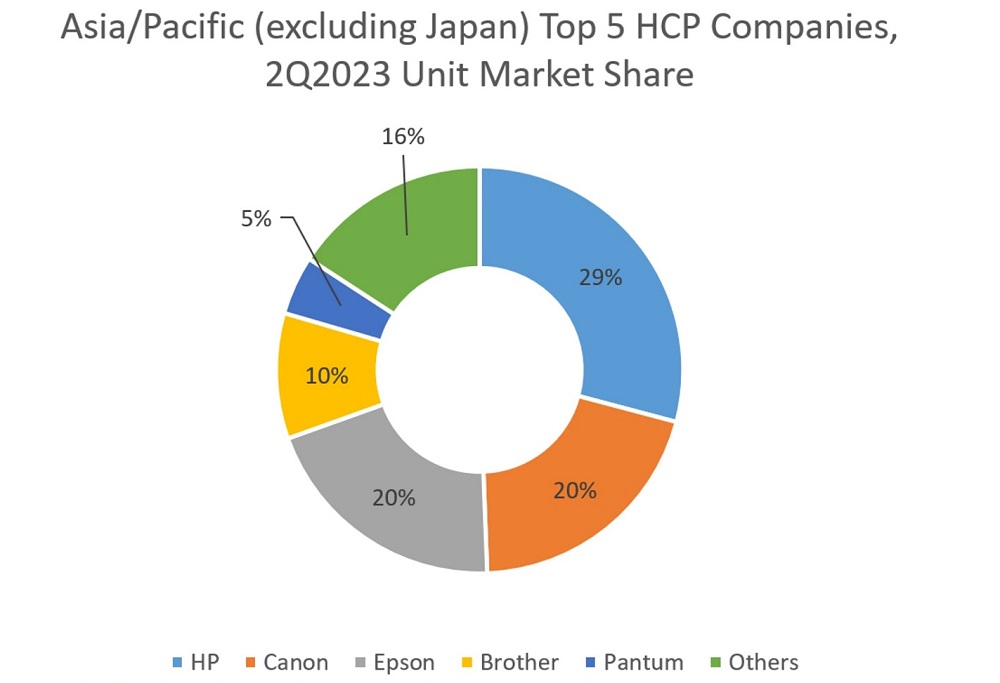

Top 3 printer brands highlights:

- HP firmly holds its market leader position in 2023Q2 despite having a market share at an all-time low. The sharp drop came from China’s inkjet market as people returned to schools/offices, significantly lessening the need for home printing. Australia, India, and Thailand show the highest YoY growth.

- Canon managed to bounce back to second place. It was previously dropped to third place in the APeJ region in Q1. The drive came from winning projects in both the government and commercial segments, particularly education, and retail. The highest YoY growth occurred in India and Korea.

- Epson dropped to third place. Epson’s campaign continues to highlight sustainability, in line with the focus of pushing ink tank models. Indonesia shows the highest YoY growth, followed by China and India.

“As the overall pent-up demand is completed, we are anticipating a softened trend towards the latter half of 2023. Students drive consumer printing above the pre-Covid level, preferring ink tanks over ink cartridges, especially wireless models,” said Paramat Arbhasil, market analyst at IDC Asia Pacific.

“On the laser side, A3 laser improves as enterprise purchase returns to normalcy while A4 laser sluggish government demand increased as budget roll-out.”