A lawmaker has pointed out the lack of certified experts and underinvestment in cybersecurity as among the factors that contributed to complacency and the false sense of security in cybercrimes.

Bohol representative Alexie B. Tutor, chair of the House Panel on Professional Regulation and a member of the House Committee on Information & Communications Technology, said the “shocking and deeply worrisome cyberattack on PhilHealth is a clear and present danger to the health security of all PhilHealth members nationwide.”

Tutor also said the country needs “cybersecurity strong enough to defend against, investigate, prosecute, and counterattack cybercriminals, especially of the ransomware and infiltration kind.”

“Kailangan ng hakbang na iyan sapagkat sobrang kaunti lamang ng Filipino IT experts on cybersecurity (it is just a tiny community) at lubhang mahal ang customized cybersecurity software, hardware, at architecture designs,” she noted.

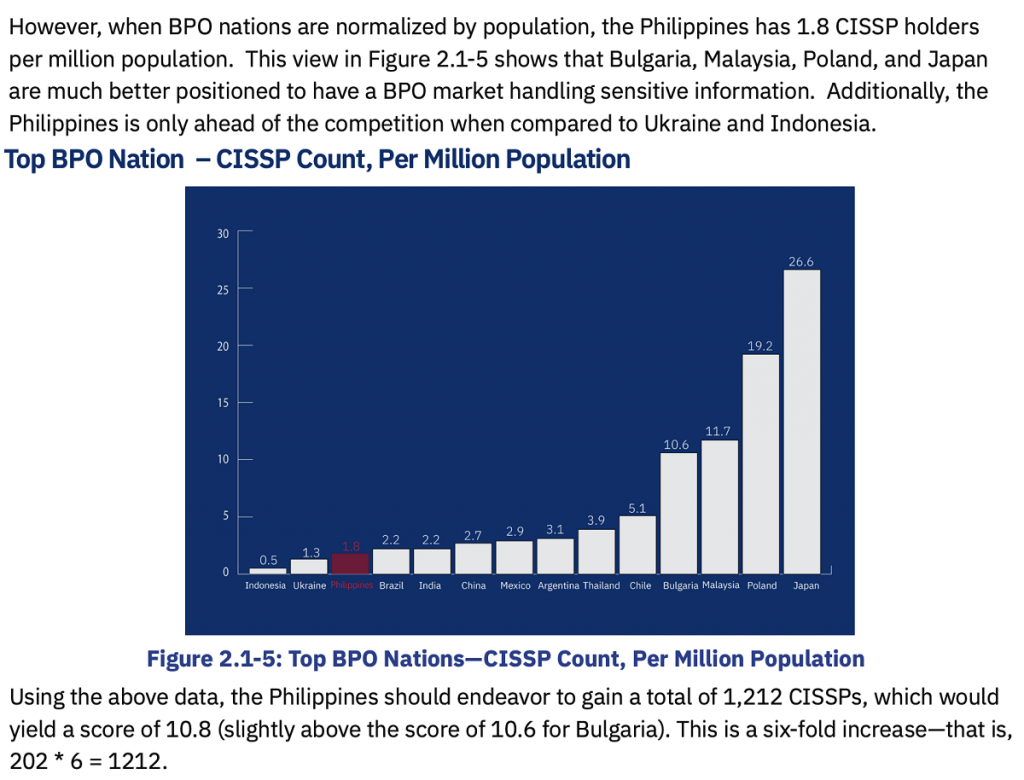

Tutor lamented, “There is a global gap and Philippine shortage of cybersecurity professionals. The gap is estimated worldwide to be around 3.4 million. Here in the Philippines, there are only around 200 certified cybersecurity specialists. We have only 1.8 certified cybersecurity experts per million population. (Yes, nakakaawa ang Pilipinas. hindi man lang umabot sa 1000 ang bilang ng mga ekspertong certified sa cybersecurity; 200 lang sa buong bansa).”

“Certified cybersecurity professionals are the ‘properly trained soldiers at the frontlines’ of defense and offense against cybercriminals,” she explained.

She added that cybersecurity “requires huge capital investments,” but the government “cannot do this alone. This needs public-private partnerships and foreign technical assistance from lenders like the Asian Development Bank, Japan International Cooperation Agency, and the World Bank.”

The World Bank said it recently approved a $600 million “digital policy loan” for the Philippines “to promote the digital transformation of government and digital infrastructure policies, expand financial inclusion through digital finance, and stimulate the growth of digital services. It will help the government digitize government operations and service delivery, foster competition in the digital infrastructure markets, and encourage the adoption of digital payments and financial services.”

“But while we wait for the capital investments in cybersecurity, we need swift measures to make sure vulnerable websites have active defenses and a protective buffer between the websites and the agency databases. There must also be redundancies to ensure public services are not interrupted or can be back online swiftly,” Tutor said.

Meanwhile, the Department of Information and Communications Technology (DICT) and the Cybercrime Investigation and Coordinating Center (CICC) said they have achieved a “milestone” with the full operation of monitoring apps in 100 sites nationwide.

The Consumer Application Monitoring System (CAMS) have been deployed in major cities such as Makati, BGC, Mandaluyong, Pasig, Antipolo, Quezon City, Pasay, Manila, Cavite, Cebu, Bagiuo, and Davao and in the provinces of Bulacan and Pampanga.

“The expanded capability will test the efficiency and safety of online users. This will insure that what works in Manila must have the same efficiency of service to other parts of the country . If there will be variations we will call the attention of the App Vendor to improve their services,” CICC executive director Alexander K. Ramos said.

“We have completed the 100 city wide locations of our CAMS Digital Observability Platform in less than a month,” Ramos said.

In addition, the CAMS is operational in over 12 countries today serving global consumers in video streaming, banking, fintech and e-commerce.

The CICC said the full installation of CAMS Observability Platform nationwide means monitoring of online applications such as delivery apps, online payment platforms, trading and business platforms and e-government apps will now be more efficient.

The project is in collaboration with Mozark, a digital company with offices in Singapore and in the Philippines.