Worldwide smartphone shipments declined 0.1% year over year to 302.8 million units in the third quarter of 2023 (3Q23), according to research firm IDC.

Although macroeconomic uncertainties linger as markets struggle with soft demand, inflation, and geopolitical tensions, healthy inventory and the slower pace of decline are encouraging some vendors to increase shipments.

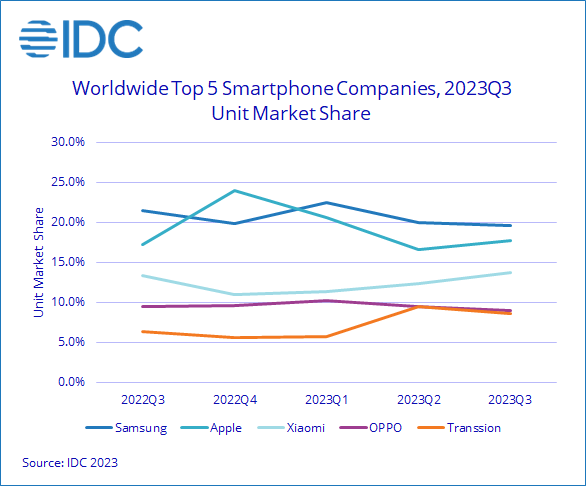

“We are seeing a strong ramp up of shipments in emerging markets by vendors like Xiaomi and Transsion,” said Nabila Popal, research director with IDC’s Mobility and Consumer Device Trackers.

“While this is a good sign of approaching recovery, vendors must keep a close eye on sell-through to avoid falling into excess inventory again, as demand is still weak in many regions.

“Meanwhile, on the other end of the spectrum, we see Apple growing in all regions except China, where it’s facing renewed competition from Huawei as well as heightened macroeconomic uncertainties that are causing consumers who once used to rush for the latest iPhones to pause and think more carefully about their purchases.”

China saw shipments fall 6.3% year over year in 3Q23, marking the tenth consecutive quarter of decline. Climbing youth unemployment, the ongoing real estate crisis, and deflation have significantly damped consumer spending and broader macroeconomic environment in China.

Elsewhere, shipments in Europe, Japan, and the US declined 8.6%, 5.3%, and 1.1% respectively.

But emerging markets like the Middle East and Africa (MEA), Latin America (LA), and Asia-Pacific (excluding Japan and China) saw 3Q23 shipment growth of 18.1%, 8.2%, and 1.3% respectively.

“The continued growth in the high-end market feels counterintuitive considering the economic challenges we are seeing across the globe,” said Anthony Scarsella, research director for mobile phones at IDC.

“Yet the high-end continues to flourish due to generous trade-in and financing options in many developed markets. However, as consumers choose premium models, the refresh cycle will continue to extend. Superior build quality, increased storage, premium features, and longer support cycles drive buyers towards the high-end as these devices last well beyond most affordable models.”