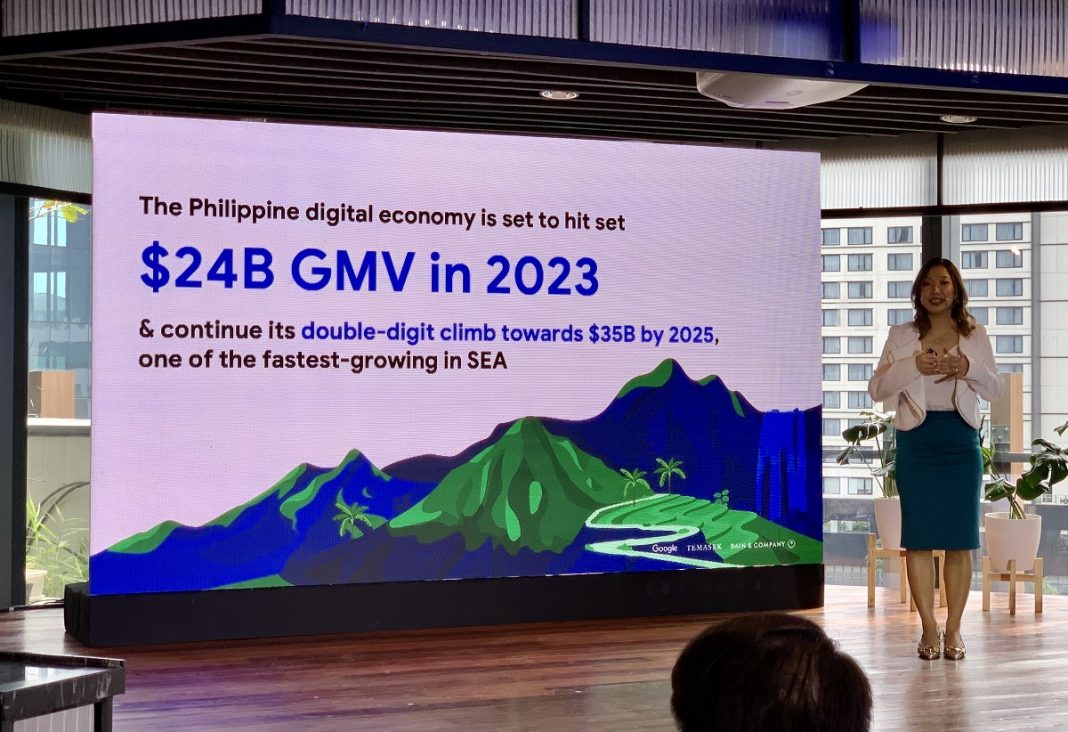

This year’s e-Conomy SEA report projects that the Philippine digital economy is on track to hit $24-billion Gross Merchandise Value (GMV) in 2023, after growing at 13% compound annual growth rate (CAGR) mainly driven by e-commerce.

By 2025, the local digital economy is set to continue its double-digit climb towards $35-billion GMV, growing at 20% CAGR, making the Philippines one of the fastest-growing digital economies in Southeast Asia (SEA).

The annual report, which combines Google Trends, Temasek insights and Bain & Company analysis, as well as industry sources and expert interviews, spotlights the digital economies of six countries in SEA: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

This is the first year the report shares revenue numbers in addition to GMV, providing a more detailed look at how businesses have accelerated growth amidst macroeconomic headwinds.

Among the findings, the report revealed that SEA’s revenue from the digital economy is poised to hit $100 billion this year, growing 1.7x as fast as the region’s GMV.

It also takes a deep dive into the opportunities of increasing digital participation to unlock further growth in the region’s digital decade.

Accounting for 70% of the overall online activities, e-commerce remains to be the main growth driver of the Philippine digital economy.

Benefiting from the shift of informal, unorganized commerce to organized digital platforms, e-commerce is expected to reach $24-billion GMV by 2025 at 21% CAGR. This is followed by online media which is set to reach $5 billion and online travel which is expected to grow to $4 billion by 2025.

Online rravel shows the largest growth from 2022 to 2023 at 88% due to the ongoing momentum of tourism.

This year, the local digital economy is also marked by having the fastest growing transport and food, online media and online travel sectors in SEA. Both domestic and regional transport providers are expanding to outer cities to fuel long-term growth.

To capture these segments, businesses have started growing their two-wheeler offerings as a more affordable alternative mode of transportation.

Here are the rest of the key insights into the Philippine digital economy:

- Healthy expansion is set to continue – In addition to rising domestic demand, a recovery in the services sector (including services exports) will drive growth over the medium to long term. Meanwhile, private consumption will see an uptick driven by lower unemployment rate, increased remittances from overseas, and tourism recovery.

- Online media which comprises music, video streaming, and online gaming is projected to grow at $3-billion GMV in 2023, at 13% CAGR. This sector is also expected to reach $5B by 2025 at 19% CAGR.

- Transport and food delivery are projected to reach $2 billion GMV in 2023 and continue to grow at 19% CAGR to hit $3-billion GMV in 2025. The momentum in mobility – which includes return to office, travel, eating out, and brick-and-mortar shopping – contributes to transport’s growth. In fact, the Philippines has the highest spend index for this sector among High Value Users (HVUs) in SEA which is more than 21% higher than Non-High Value Users (NHVUs).

- Online travel is back with 88% growth – the highest growth rate in the local digital economy from 2022 to 2023. As recovery to pre-pandemic levels continues, travel is on its track to hit $3-billion GMV this year and is growing at 18% CAGR by 2025 where the sector is expected to reach $4 billion GMV.

- Digital payments continue to gain traction and is set to hit $93 billion this year and $126B by 2025. E-wallet and account-to-account (A2A) payment rails will see the fastest growth due to lower costs to merchants. Informal A2A payments are expected to grow in merchant adoption as they look to sidestep formal registration of business accounts with digital payments providers.

“With continued double-digit climb towards $35 billion by 2025, the country’s digital economy continues to exhibit resilience and generate opportunities for Filipinos despite macroeconomic headwinds. This momentum is poised to continue, fueled by the immense potential of AI and the digital participation of internet users outside Metro Manila which could drive medium to long term growth,” said Nikki Del Gallego, head of data and insights at Google Philippines.

Bennett Aquino, partner at Bain & Company, said: “It really is quite a feat that both Southeast Asia’s digital economy GMV and revenue continued their double-digit growth momentum despite this challenging macroeconomic environment, with revenue breaking the $100-billion mark in 2023.

“More than anything, this shows the resilience of the Southeast Asia digital economy and that the key players are figuring out the monetization puzzle and making headway towards healthier unit economics. Despite external headwinds, we are optimistic that the digital economy – both for SEA and the Philippines – will continue to grow substantially in the longer run,” he said.

The report said AI adoption is crucial as enhancing operational efficiency and improving user experience will be key for companies to achieve profitable growth.

“AI can bring a lot of value in areas such as inventory management and route optimization, and increasing deeper engagement and digital participation through personalized content recommendations in online media. AI can also play an important role in detecting and preventing fraud, increasing security for both consumers and merchants,” it said.