The Asia-Pacific excluding Japan region (APeJ) region saw a significant decline in the hardcopy peripherals (HCP) or printer market during the last quarter of 2023.

According to analyst firm IDC, the printer market declined 24.1% and shipped a total of 7.6 million units across the region.

Despite the APeJ region’s economic recovery phase, the market faced challenges due to factors such as geopolitics and rising inflation rates.

Breaking down the YoY performance of each product type:

- Inkjet printers declined by 30.2%;

- Laser devices (including A4 and A3 machines) declined by 13.5%; and

- Serial Dot Matrix (SDM) segment declined by 29.4%.

IDC data showed that the total inkjet market in Q4 was the third consecutive quarter of decline. The drop was mainly contributed by the steeper decline rate for the ink cartridge segment of 43.1%.

The retail sector in most of the countries had been affected by the slow macroeconomic condition. Demand for consumer-facing products especially ink cartridge printers had shrunk drastically even though prices were discounted heavily across multiple brands.

The countries which managed to capture growth for ink cartridges were Bangladesh, Vietnam, India, the Philippines, Malaysia, and Thailand mainly because of the replacements of older machines bought before the pandemic.

As for the ink tank segment, only Sri Lanka, Bangladesh, Vietnam, and Indonesia managed to observe YoY growth.

In Q1 and Q2 of 2024, elections will be held in certain countries like India, Indonesia, Korea, Taiwan, and Sri Lanka. Q4 of 2023 was considered a pre-election period and governments in these countries had tightened their budget and reallocated them for other government spending instead of IT spending.

Political uncertainty was also one of the factors that caused businesses to hold their spending. Other than the effects of elections, in other parts of the region, IDC also observed that the purchases from commercial users mainly SMBs continued to cool down which led to the laser A4 segment decline by 14.5%.

In contrast, the Laser A3 segment has only experienced a minor decline of 3.6% thanks to document solutions and service tie-in contracts.

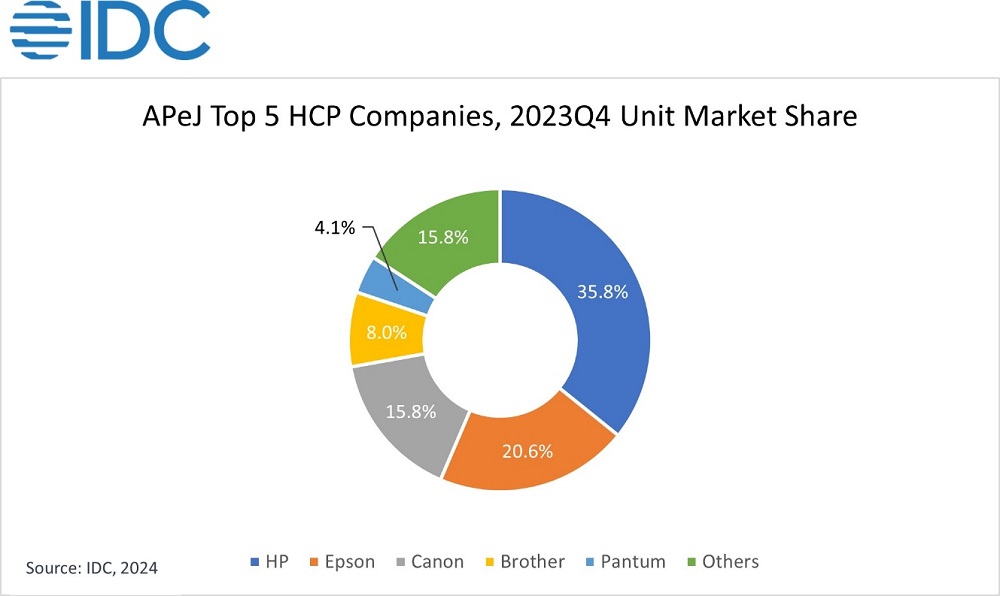

Top 3 Home/Office printer brand highlights:

- HP claimed the top position in the market and even overtook Epson as the top vendor in total inkjet market for 2023Q4. However, the shipments for HP in the quarter dropped by 28.7%. One of the major reasons was due to the decline in shipments for Laser A4. This segment was impacted by the migration towards ink tank products in many countries.

- Epson continued to dominate the ink tank segment. Although, the trend of users switching from Laser A4 to ink tank was still on-going, the transition rate was slowing down. The market outlook did align with IDC’s forecast. Demand across SMB and SOHO segments for ink tanks cooled down after witnessing strong growth trends in historical quarters.

- Canon placed third in 2023Q4, with a YoY decline of 26.5%. Although, Canon’s inkjet segment faced a drop in shipments, their total laser segment grew by 2.1% YoY. It was contributed by the recovery in mono segment which drove by some of the demand from large corporates and government accounts.

“As expected from our previous forecast, Q4 shipments did improve quarter-on-quarter but declined YoY. The total HCP market took a major downturn in the second half of 2023 as compared to the same period of 2022 because of the weaker demand for print from consumer and commercial segments. We do not anticipate any signs of significant recovery in the first half of 2024,” said Yi Karl Tai, research analyst at IDC Asia Pacific.