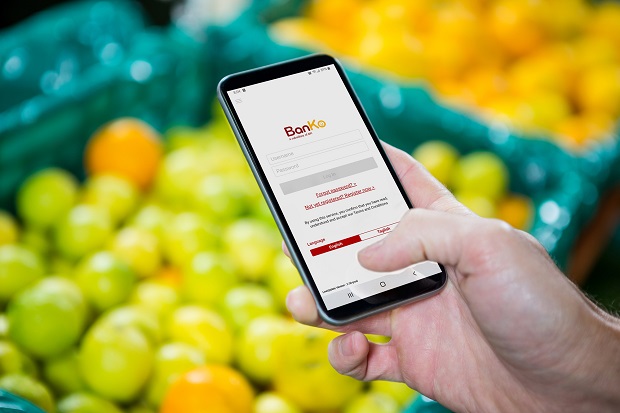

BPI Direct BanKo, the microfinance arm of the Bank of the Philippine Islands (BPI), has announced it is offering its mobile banking app for its microfinance clients.

Urging customers to go digital in this time of Covid-19, BanKo head of financial inclusion and microfinance loans Rod Mabiasen, Jr. said, “We are innovating in the midst of the pandemic for the sake of our clients. Our goal is to continue guiding them to adapt in the new normal through this easy, hassle-free online banking initiative.”

Through BanKo Mobile, NegosyoKo borrowers may view the schedule of their repayments, check their balance and payment history, and even pay their loans without having to leave their home or store, which is very convenient given the current restrictions and difficulty in transportation.

“It is important for our clients to have an easy access to their money. They can now monitor their accounts anytime, anywhere through our new mobile banking application,” Mabiasen said.

BanKo is not only encouraging its existing clients of self-employed micro-entrepreneurs (SEME) but also new customers to download the app through Google Play or App Store.

Mabiasen said the app will make it convenient for the micro-entrepreneurs to save and closely monitor their accounts without leaving their stores.

Through the mobile app, new clients may conveniently open a PondoKo savings account with no maintaining balance and as low as P50 initial deposit. With a few taps, accountholders may also buy prepaid load in any network with 2% rebate, as well as transfer money, and pay bills.

Even in these trying times, BanKo loans associates called BanKoPares and BanKoMares continue to check their clients’ situation and advise them on ways to sustain their businesses.

“BanKo remains open and ready to help our SEMEs to rise up and recover during this difficult period. They should not be afraid to reach out to us because our priority is to support them and their businesses. As their partner, we will respond to their needs however we can,” he added.

Since introducing NegosyoKo Loan to the market in 2016, BanKo has already served over 120,000 clients nationwide and released over P12 billion in loans.