Most Filipinos consider themselves to be lower middle class, according to the Credit Perception Index (CPI) study by TransUnion, a global information and insights company.

The findings suggest that — while many Filipinos have a conservative outlook on their financial status — the reality remains that many Filipinos belong to a growing middle class.

The middle class is defined by the government as those earning incomes that are two to 12 times the poverty line. The latest Family Income and Expenditure surveys conducted by the Philippine Statistics Authority show that the middle class comprises around 40% of the population.

Meanwhile, the National Economic and Development Authority (NEDA) reported that the Philippines is on track to be an upper middle-income country by 2025.

Additional findings from the CPI study also showed that a majority of Filipinos among the general population claim to have a strong understanding of their finances.

Also, while most plan to save more as they expect their household incomes to rise, less than a quarter (21%) are planning to borrow or use credit products in the next year.

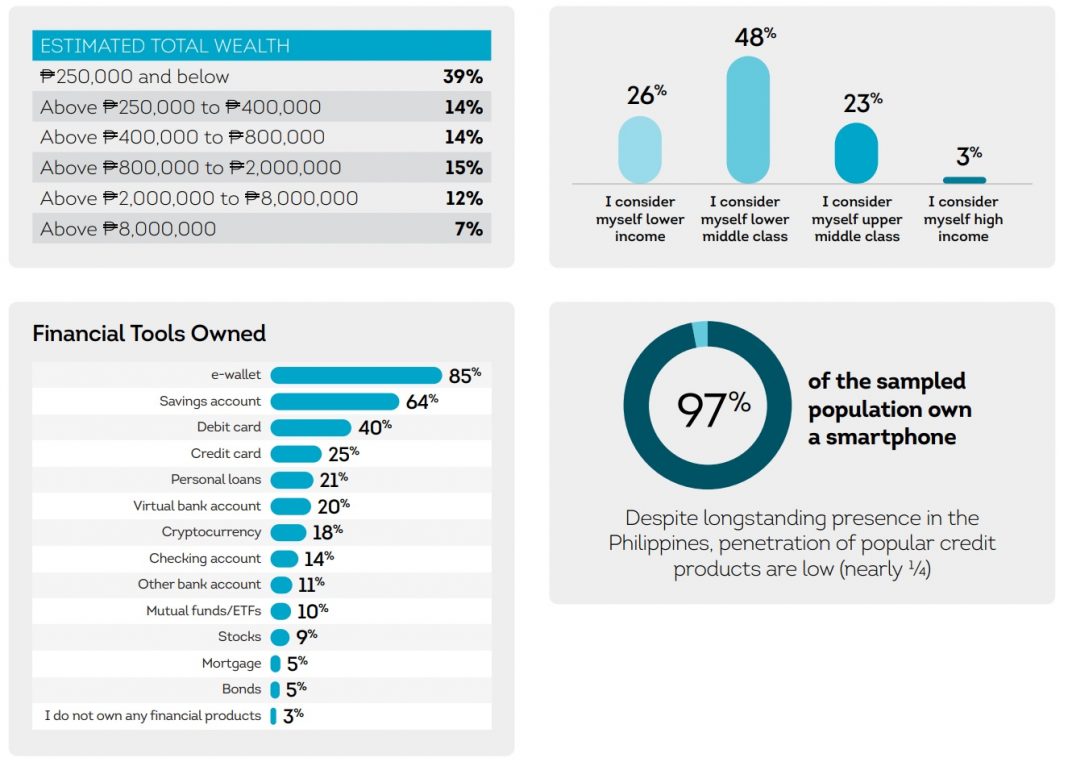

The TransUnion CPI study revealed a majority (71%) of respondents consider themselves to be middle class. However, a deeper dive into the statistics shows that most respondents from Gen Z (45%), Millennials (49%), Gen X (51%), and Boomers (48%) identify as part of the lower middle class.

This perception may be attributed to views on personal wealth, as more than a third of the population (39%) see themselves as having low total wealth.

Despite most of the population considering themselves to be lower middle class, there were disparities in knowledge of credit.

Millennials made up the highest proportion of the credit knowledgeable, at 41%, followed by Gen Z (31%) and Gen X (22%), with Boomers (6%) being the smallest portion of the credit knowledgeable surveyed.

Filipinos would rather save money than use credit

A majority (79%) of respondents said they considered themselves to have a strong understanding of their finances. While 72% said they can easily afford their day-to-day necessities, half (51%) of total respondents said they often find themselves with limited money at the end of every month.

In terms of their expectations on how their finances will change in the future, most respondents indicated a desire to save more, as they expect their household incomes to rise.

However, few respondents had plans to borrow or use credit to make purchases in the future. In fact, 21% reported plans to do so in the next three months, 21% in the next year, and 24% in the next five years.

“The decision to avoid the future use of credit is indicative of a conservative financial mindset, where it isn’t always understood and seen as an opportunity for economic mobility,” said Pia Arellano, president and CEO of TransUnion Philippines.

“This coincides with a longstanding stigma across our nation surrounding credit, as it’s often viewed as a gateway to bad unmanageable debt and financial irresponsibility.”

More than half (57%) of the CPI respondents said they are open to both innovative and traditional ways of financial transactions. Most respondents (41%) indicated they are also comfortable paying for big purchases with one-time payments or installments.

Additionally, when told how credit influences loan approvals and job applications, and how it can help them achieve their financial goals, 90% of respondents said that this information may influence their likelihood to use credit-based products in the future.

This presents an opportunity for the formal financial sector to bridge any misperceptions that Filipinos might have about responsible credit use through credit education, the report said.

While banks and financial institutions are seen as credible sources of information on credit products among all segments of the population, they lag in preference among Gen Z and Millennials.

Family and friends emerged as the most preferred sources for credit information among Gen Z (66%) and Millennials (69%). These findings are in stark contrast to the older segments of the population where banks and financial institutions as their most preferred source of information of credit products among Gen X (71%) and Boomers (79%).

“For younger generations who are just beginning to build wealth, the formal financial sector must focus its efforts on educating Filipinos about how the responsible use of credit can help them achieve their goals in life. Alongside the promotion of good financial habits, the responsible use of credit can help more Filipinos enjoy economic mobility by enabling them to access opportunities for better lives,” said Arellano.