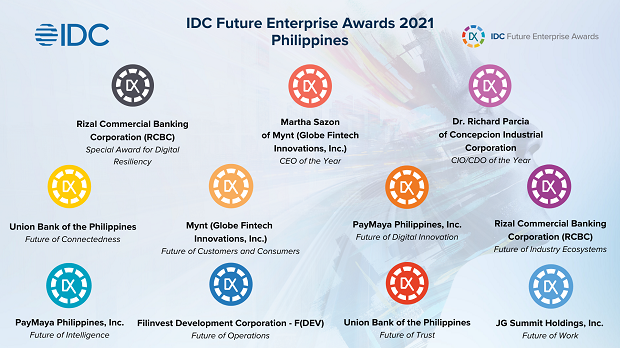

IDC Philippines announced on Thursday, Oct. 7, during its IDC Future Enterprise Awards Philippines that Martha Sazon of Mynt (operator of GCash) has been recognized as CEO of the Year and Dr. Richard Parcia of Concepcion Industrial Corporation named as CIO/CDO of the Year.

Joining Mynt and Concepcion Industrial Corporation as Philippines winners are: RCBC, Union Bank of the Philippines, PayMaya Philippines, Filinvest Development Corporation, and JG Summit Holdings, Inc.

IDC said the winners asserted their leadership amid a pandemic and distinguished themselves from more than 1000 entries received from close to 700 end-user organizations across Asia-Pacific.

They were chosen based on their successful implementation of digital initiatives that address new customer requirements, development of new capabilities, deployment of new critical infrastructure, and pursuit of new industry ecosystems.

“The nominations this year attest how businesses leaders have embraced the urgent need to transform to a digital business in order to survive and grow during these changing times as well as how consumers have adopted to a widespread use of digital wallets. With the Philippines in the early stages of digital maturity, it is exciting to see how these changes will bring about the greatest opportunity to organizations,” said Angela Jenny Medez, market analyst at IDC Philippines.

Here are this year’s Future Enterprise Awards categories and winners, featuring nine new digital agenda items that will be the new benchmarks for what it takes to lead in the changed world:

• Agency Banking – Deposit and Send Cash through Bank Partners by Union Bank of the Philippines named as Best in Future of Connectedness:

During the lockdown last year due to the pandemic, Filipinos had limited mobility. UnionBank responded to the challenge, and in thee weeks’ time, it created a service that will enable bank customers to send money to through its partners.

Agency Banking is in partnership with retail businesses such as payment centers, pawnshops, malls, and convenience stores to fulfill banking services. This has accelerated banking touchpoint expansion. These partner agents cover 11,000 branches which covers 70% of the total cities and municipalities of the country.

Agency Banking was instrumental in enabling its customers to continue to deposit to their accounts and send cash to their families, relatives and associates given the limited mobility allowed. Its success has drawn interest from several enterprises engaged in logistics and retailing as well as potential partnerships with digital service, remittance, and payment providers who want to be a part of the network.

• Go Cashless with GCash by Mynt named as Best in Future of Customers and Consumers:

The Covid-19 pandemic has reshaped relationships, work, and daily activities in unprecedented ways. With people mandated to stay at home to mitigate spread of the virus and only essential businesses allowed to operate, everyone had to shift their daily activities online.

With the “Stay at Home” lifestyle, GCash emerged to make Filipino lives better by providing finance solutions for all. Within the app, customers can send or borrow pre-paid mobile phone load, send, and receive money, make bank transfers, pay bills, and even shop for their essential and lifestyle needs via QR code, all while staying safely in the comforts of their homes.

GCash also became vital in ensuring money reached out to those who needed it most. GCash provided support to the government in distributing P16 billion to more than 2 million Filipino families and the nation’s frontliners. At least P40 million in donations for Covid-19 and typhoon relief were distributed to various non-government organizations.

• PayMaya Negosyo, a free business-in-a-box solution for every MSME by PayMaya Philippines named as Best in Future of Digital Innovation:

With many businesses turning to digital amid the Covid-19 pandemic, PayMaya rolled out PayMaya Negosyo, a free business-in-a-box app that allows micro, small, and medium-sized enterprises (MSMEs) to accept payments from anyone, even without using an e-commerce platform.

With the app, PayMaya is transforming its nation-widest network of 39,000 Smart Padala domestic remittance agents to become one-stop shops that serve the unbanked in last-mile communities. Leveraging its e-Wallet, Acquiring, and Domestic Remittance businesses, PayMaya has allowed MSMEs through the app to earn additional income by offering cash-out services, bills payments, selling prepaid loads and gaming pins, processing domestic remittance, and adding money to PayMaya accounts of PayMaya users in their communities.

Because of this innovation, PayMaya saw 3,000% growth in the number of unique small merchants onboarded in 2020 year-on-year. Small merchants using PayMaya Negosyo account for about over 80% of total merchant partners in 2020.

• DiskarTech Financial Inclusion Super App by Rizal Commercial Banking Corporation named as Best in Future of Industry Ecosystems and Special Award for Digital Resiliency:

The DiskarTech financial inclusion super app was created to provide valuable financial products and services to the unbanked and the underserved Filipinos, including those living in geographically isolated and disadvantaged areas. It is the only digital banking app that uses the local Filipino-English vernacular (Taglish) in its interface, making it more accessible and more understandable to the layman and removing the language barrier that makes other banking app’s intimidating.

DiskarTech offers basic deposit account features boosted by various added features including telemedicine, electronic load and gaming pins, and sachet-type financial features such as microinsurance and short-term loans.

DiskarTech continues to achieve financial inclusion and push for digital acceleration by onboarding Filipinos into the formal financial system. Proof of this is the nearly 4 million app downloads only 10 months after its release, with 2.6 million who registered as users.

• PayMaya Mission: Accelerating financial inclusion through enhanced, AI-powered e-KYC process by PayMaya Philippines named as Best in Future of Intelligence:

Amid Covid-19, PayMaya experienced exponential surge of new account users, significantly from government beneficiaries, micro, small, and medium enterprises (MSMEs). To scale the provision of financial accounts for Filipinos, PayMaya rolled out in June 2020 an AI technology-powered ID Validation (IDVal) Service, which automated face matching, ID classification, and ID Optical Character Recognition (ID OCR), eliminating the manual processing of upgrade applications including ID submission and face-to-face video call.

The development has removed its backlog as PayMaya can process 89% of upgrade applications in two minutes and 99% fulfilled within 24 hours. It eliminated the need to hire outsourced manpower for its KYC process, resulting to cost reduction in operational expenses by 70%. Total registered users for these consumer platforms doubled in just 18 months as of June 2021 to 38 million, or more than half of the adult population.

• F(DEV) – Procurement DX by Filinvest Development Corporation – F(DEV) named as Best in Future of Operations:

The conglomerate aims to bring its processes into the digital future and this project helps in pushing that initial step to digitalizing one of the most important processes in the company – procurement. The group facilitates the purchase orders in the billions of pesos; however, the end-to-end purchasing journey is fragmented and highly inefficient because of the mix of manual tools, proprietary/legacy systems, and operating company specific processes.

The project sought to re-engineer the end-to-end buying process through an online Business-to-Business (B2B) ecommerce platform using a combination of startup mentality and partnership, agile product development approach and single threaded leadership to ensure that milestones are achieved quickly, and learnings are baked into the next set of activities. The traction within the conglomerate has been significant that the project team has spun this DX initiative off as its own business to be monetized externally.

• Project Ethics – Fairness Assessment Methodology by Union Bank of the Philippines named as Best in Future of Trust:

The use of AI has been prevalent in the recent years, facilitating more intelligent decisions, identifying underlying trends and reducing the need for repetitive laborious tasks. However great the AI systems are, it comes with great challenges as well. UBP has anticipated this and is continuously striving towards a fairer and more ethical use of AI.

Project Ethics will lead to the development and application of fairness in different stages of model development lifecycle. It seeks to improve the Bank’s Model Development Lifecycle and proactively address regulatory requirements and global standards.

Furthermore, the project will help the bank prevent systematic bias which may have been implemented in the as-is to to-be Artificial Intelligence/Machine Learning with the end goal of improving customer wellbeing by identifying the risks and benefits of the system, measuring their impact on customers, and taking steps to mitigate any harm or systemic disadvantage.

• JG Summit Employee Experience by JG Summit Holdings named as Best in Future of Work:

Beyond providing its employees with fair and proper compensation, delivering government- mandated benefits and requirements, and keeping the workplace environment healthy and safe, the company constantly seeks ways to make its employees’ lives simpler yet more productive and more fulfilling.

In 2019, a dedicated Employee Experience team was formed to fulfill that mandate. The first phase of its Future of Work strategy involved transforming into an employee-centric and employee-obsessed organization by constantly monitoring employee feedback and sentiment across the whole organization, providing Employee Productivity enablers that not only make them productive but also give Employee Delight while they do the work that they do, operating critical projects that is crucial for the workforce efficiently and employee-friction-free.

By doing all of these, JG Summit was able to devise actions to retain employee engagement albeit the remote work and develop plans on how to ensure the business is running under the critical circumstances.

• Martha Sazon of Mynt named as CEO of the Year:

It was at the height of the Covid-19 pandemic in June 2020 that Martha Sazon was appointed as the CEO of Mynt, known for its fintech application in the Philippines, GCash. Rather than be daunted by the difficult circumstances facing consumers and businesses brought by the ongoing pandemic, Martha saw the wide range of opportunities it presented to serve Filipinos — 2 out of 3 of whom remain unbanked and without access to financial services at this crucial time.

Recognizing this, Sazon was eager to face the challenge. Under her leadership, it did not take long for GCash to grow and make a difference across the country — even in remote rural areas that are often left unreached. Today, GCash has doubled the number of its registered users from over 20 million in January 2020 to over 40 million by May 2021 with about 40% of Filipinos having a GCash account.

• Dr. Richard Parcia of Concepcion Industrial Corporation named as CIO/CDO of the Year:

With CIC’s Vision to create happy spaces and become an integral part of every Filipino home and business, it needs to cater to the evolving demands and needs of their customers. It is able to do this through the integration of modern technology and platforms that empowers the organization.

Richard Parcia’s main projects involve digital maturity and data management. He believes that in infrastructure, and operations in general, you always need to be ahead of the curve. As the CIO, he provides the strategic direction to all of CIC’s transformation initiatives.

Adhering to CIC’s mantra of putting its customers at its core, he puts an emphasis for continuous innovation as noted in the kind of solutions that the company now offers. From traditional cooling systems, CIC has expanded its services and solutions to advanced technologies including smart-home, and unique offers versus its competitors.