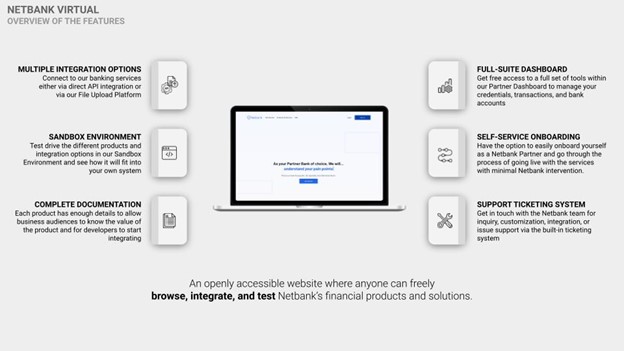

Netbank, a fully-regulated bank that offers Banking-as-a-Service solutions, has unveiled Netbank Virtual, an openly accessible Web-based platform where anyone can browse, test, and integrate Netbank’s financial products and solutions.

“While some larger local banks have started to offer banking services through API, none have built the technology and the business from scratch, as we have done at Netbank”, said Gus Poston, Netbank’s co-founder.

“We use the latest technology, which means we can offer services at much lower cost. Netbank Virtual will rapidly accelerate the collaboration between fintechs and banks. Netbank Virtual allows fintechs to offer a much wider range of services, which will accelerate innovation and achieve the BSP’s goals of greater financial inclusion”.

Netbank has engaged Brankas, a Open Finance technology company in Southeast Asia, as its technology provider to build and deliver this service.

“Netbank is transforming access to banking services, with a new approach that enables any business to offer fintech solutions,” said Krizelle Lazatin, Brankas territory manager for Philippines.

Brankas CEO Todd Schweitzer added, “Together, Brankas and Netbank are helping enable the next generation of fintech businesses, expand financial inclusion, and give customers more choice and flexibility.”

Any company in the Philippines can seamlessly embed financial solutions into their products and services, in a much more efficient and low-cost manner than through traditional channels.

“By combining Brankas’ technical expertise with Netbank’s Banking-as-a-Service approach, we can provide automated account opening, payments, disbursements, cards and even loans via digital channels such as white labeled mobile apps and banking-as-a-service APIs”, added Dave dela Paz, Netbank co-founder and head of Netbank Virtual.