A new study from network diagnostics company Ookla said the Philippine telecom industry is no longer a duopoly controlled by Globe Telecom and Smart-PLDT with new player Dito Telecommunity slowly gaining market share after entering the market in March 2021.

The report said the Dennis Uy-owned operator has so far met all of its coverage and performance obligations, even as it plans further investment and expansion of its 4G and 5G networks.

Dito’s license came with coverage and performance obligations, which are tracked by technical audits performed on behalf of the National Telecommunications Commission (NTC). Repetitive failure to deliver on its commitments would result in the loss of its franchise and the forfeiture of a multi-billion-peso bond, the report noted.

Dito has committed to a five-year network rollout plan as follows:

- First Year: commitment to reach more than 37.01% country population with a minimum average broadband speed of 27 Mbps — Dito achieved 37.48% population coverage as per February 2021 Audit

- Second Year: Dito exceeded its 51.01% population coverage target (achieved 52.57% population coverage) as per September 2021 Audit.

- Third Year: 70% population coverage audited in July 2022, Dito’s current coverage is around 64%-65%.

- Fifth Year: 84% population coverage obligation, which the operator itself has increased to over 90% by the end of its five-year network rollout program and average mobile Internet speed of 55 Mbps speed.

The Ookla report observed that Dito’s strategy wasn’t to start a price war with the incumbent operators. “Rather, the goal is to win consumers’ mindshare by delivering faster speeds, differentiated customer experience and simpler products,” it said.

The operator tapped into its parent company’s distribution network — retail stores of Udenna Group and gasoline stations of Phoenix Petroleum to distribute its services. It also leveraged China Telecom’s know-how and funding, the report said.

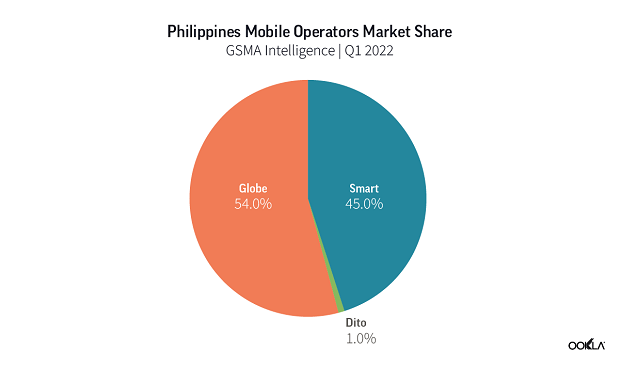

One year on, in Q1 2022, Globe was the market leader by subscriber numbers, with 87.4 million, Smart followed with 70.3 million. Dito, on the other hand, held a 1% market share.

“On March 15, 2022, it announced it had 7 million subscribers, which is lower than we would expect from a new market entrant. Dito targets 12 million subscribers by year end, which seems within its reach, as it has recently announced reaching 9 million customers as of June 2022,” the report said.

“Its gains are aided by its promotional packages such as unlimited data for 30 days promotion with 25 GB of data, unlimited text and 300 minutes of calls. One of Dito’s challenges is that it doesn’t operate 2G and 3G networks so its customers have to have 4G-capable phones.”

Since Dito is a 4G-only operator, the report said it was not surprising that it also had the best 4G Availability in Q1 2022 (91.2%), ahead of Globe (84.9%) and Smart (83.8%) that provide access to all network technologies 2G, 3G, 4G, and 5G.

“Additionally, Dito, despite facing challenges raising funding, plans to invest P50 billion ($915 million) during 2022 in the network roll out in order to adhere to its license obligations, which we outlined here, that specify its population coverage and network speeds,” it said.

Ookla said it analysis suggested that Dito’s entry, combined with regulatory changes, resulted in more network investment and an overall improvement in 4G coverage and performance across all operators.