Professional social media platform LinkedIn said major financial players in the Philippines such as BDO, Maya, China Bank, and Security Bank are positioning themselves for greater agility and innovation to capture opportunities in the underserved banking population and promote financial inclusion for all.

The company said these institutions are partnering with platforms such as LinkedIn to enhance their hiring processes to attract top talent, invest in large-scale workforce upskilling, and develop internal frameworks to identify and bridge skills gaps.

These firms are leading the way in revolutionizing the industry in the Philippines, where there is a national push to have 7 out of 10 adults have access to a transaction account by end-2023. The country’s rising young, tech-savvy consumer base also drives the surge for digital and innovative financial services.

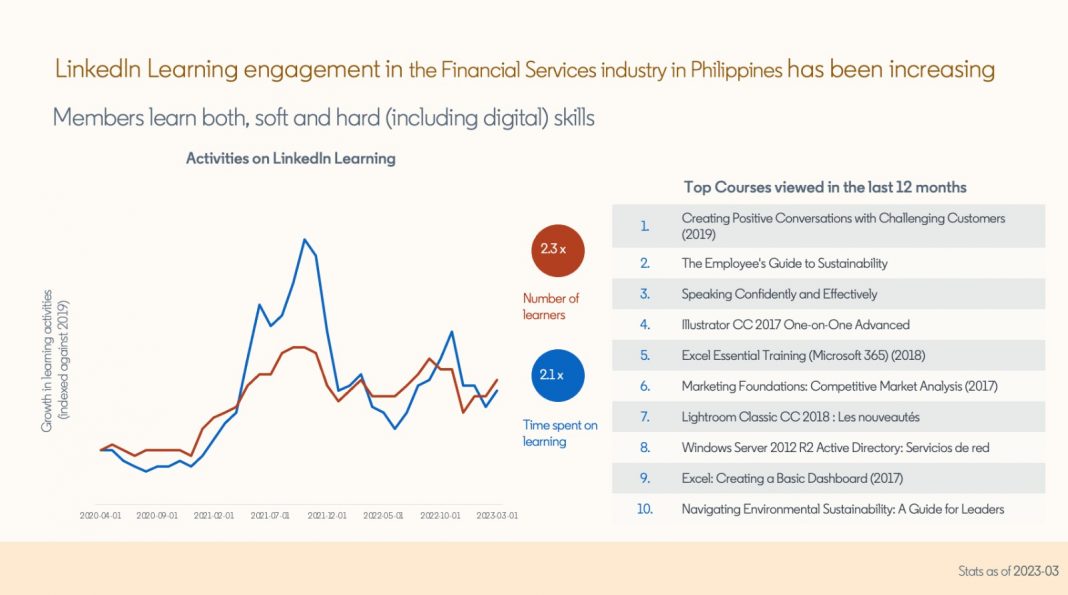

LinkedIn Learning, LinkedIn’s intelligent learning platform, has seen busy activity over the past three years from professionals and business leaders in the Philippines’ financial services industry, with the number of learners (2.3x) and time spent on learning (2.1x) increasing by over two-fold from April 2020 to March 2023.

Two of the most popular courses in the industry in the past year are “Creating Positive Outcomes with Challenging Customers” and “Navigating Environmental Sustainability: A Guide for Leaders,” suggesting the companies’ focus on creating more inclusive and sustainable financial products and services.

“Since LinkedIn’s launch 20 years ago, we have partnered with businesses and professionals through an ever-changing world of work. We are uniquely positioned to leverage our rich data insights as well as our library of the most in-demand skills to help companies find and develop diverse talents to transform the country’s financial system. We are committed to partner the industry as it rapidly digitalizes and as the Philippines progress towards financial inclusion for all,” Atul Harkisanka, head of emerging markets and country manager for the Philippines at LinkedIn, said.

Security Bank employees nationwide have been very engaged learners, viewing more than 11 million course videos on LinkedIn Learning in 2022, as the bank looks to build a workforce with strong digital skills and business acumen.

Last year, it built a “Capability Framework” to address workforce skill gaps, starting with their leadership team.

“We’re able to use LinkedIn Learning in a more focused way and curate courses that bridge the skills gap across all leadership levels and pave the way for more personalized learning paths for our employees,” Nerissa Berba, SVP and chief human resources officer of SBC, said.

“LinkedIn Learning has provided our employees with access to learning material anytime. The pace of adoption was at lightning speed, and we achieved a 100% activation rate within six months of launch in 2021.”

Maya has been leveraging industry data insights to identify and bridge skill gaps and improve its hiring processes to source top talent with diverse skill sets. Maya saw a 33% year-on-year increase in hiring efforts to support its business growth last year.

“In 2022, Maya underwent a significant transformation with the rebranding and official launch of Maya Bank. Our goal is to be a game changer in fintech, offering a financial ecosystem tailored to the needs of the Philippines. To achieve this, we recognize how important it is to attract and retain top-tier fintech and digital talents,” Charee Lanza, chief people officer at Maya, said.

“Besides leveraging LinkedIn Learning to keep pace with in-demand skills, LinkedIn Talent Insights allows us to comprehensively understand emerging skill requirements and market demands, strategically targeting local and regional talent in data science, artificial intelligence, and product management, which has been instrumental in optimizing our hiring efficiency and diversity. We have grown our talent pool outside Metro Manila by 700% (7x) and outside the Philippines by nearly 70% since 2021.”

BDO said that responsiveness and strong accountability are attributes it looks for to cultivate a culture of innovation balanced with risk mitigation and good governance in response to the changing times.

“We are committed to contributing to the country’s sustained growth in the financial services industry through economic activities that empower Filipino consumers and develop an environmentally-responsible and socially-inclusive workforce,” Evelyn Salagubang, SVP and head of the Human Resources Group at BDO, said.

For its part, China Bank prioritizes cybersecurity and has deployed regulatory courses such as data privacy and operational risk management. Its multigenerational workforce is upskilling by taking these courses and more through LinkedIn Learning.

“LinkedIn Learning has proven efficient in helping us build skills at scale and address critical skill gaps across the enterprise. With 80% of our workforce from Gen Y and Z, it caters to various contemporary learning styles and professional development requirements with on-the-go, bite-sized learning. In a recent project presentation by one of our staff, he shared that he could create his database and dashboard project while referencing LinkedIn courses,” John Camarillo, division head of learning and capability development at China Bank, said.

“This is a strong indicator of an emerging culture of self-directed learning, which will be the future of learning, especially as it is now imperative to build and refresh your skills in a fast-changing landscape constantly.”